Uber’s latest move in the race for autonomous mobility signals both ambition and timing. In October 2025, the company announced a premium robotaxi service set to launch in late 2026 across the San Francisco Bay Area. The plan unites three major players: Uber’s global rideshare platform, Lucid Motors’ electric Gravity SUVs, and Nuro’s autonomous driving technology. Together, they aim to challenge Waymo’s long-standing dominance in the self-driving arena.

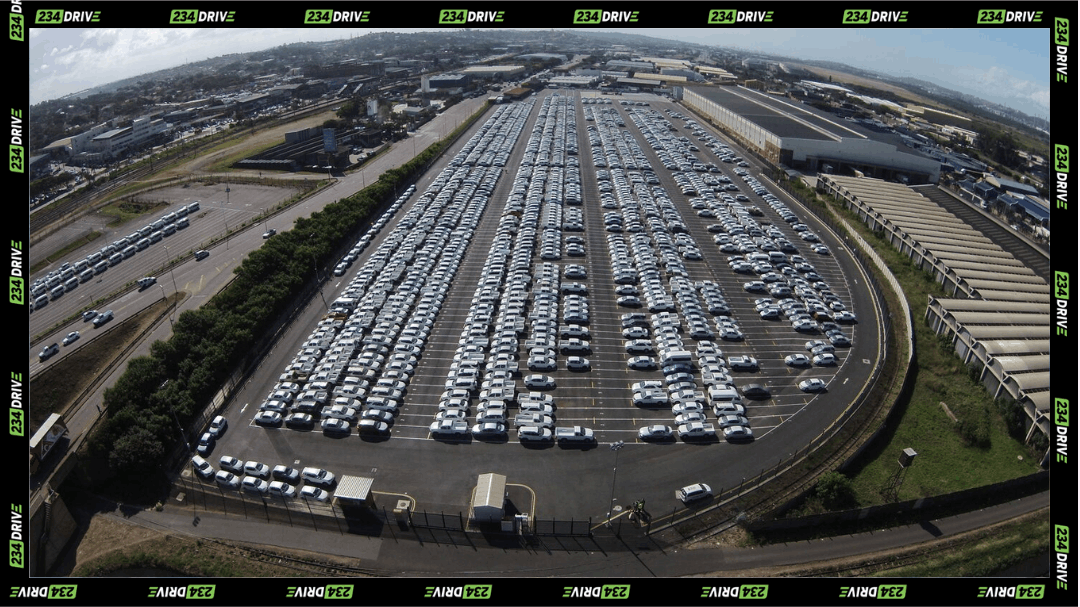

Uber is investing $300 million into Lucid and has committed to purchasing at least 20,000 Gravity SUVs over six years. Early road tests are already in motion, with about 100 vehicles under evaluation on closed courses and public roads. The Lucid Gravity, a high-performance luxury SUV, offers a blend of range, comfort, and design fit for premium users, while Nuro’s machine learning systems provide the self-driving intelligence. It’s a strategic partnership: Lucid builds, Nuro powers, and Uber scales.

This launch marks a turning point for Uber’s strategy. After years of setbacks in autonomous driving, including selling its self-driving unit in 2020, the company is returning with a clearer vision, partnering instead of building from scratch. By using Lucid’s EV expertise and Nuro’s robotics background, Uber positions itself to scale autonomy faster while avoiding the development costs that previously burned billions. The Bay Area, with its mix of tech culture and regulatory openness, provides the ideal testing ground.

San Francisco Mayor Daniel Lurie’s administration has openly welcomed this new wave of mobility. Since taking office in January 2025, Lurie has branded the city as a testbed for emerging technology. He’s praised companies like Waymo for their safety records and sees similar programs as tools to revive downtown traffic and tourism. “We should be the testbed for emerging technology and AI,” he said, calling it part of San Francisco’s DNA. His government has already cleared limited robotaxi routes along Market Street and hinted at support for airport expansions.

Still, the human cost isn’t lost on the city. Rideshare drivers and labour unions have raised alarms over job displacement. Veteran drivers report declining ride volumes in zones dominated by Waymo, while unions like the Teamsters are lobbying for policies to protect employment as automation spreads. Uber insists that the transition will be gradual, pointing to hybrid operations where both robotaxis and human drivers coexist. But the broader concern remains: what happens when the shift becomes permanent?

Meanwhile, another startup is redefining what ‘urban transport innovation’ means. Glīd, a freight mobility company, won the 2025 TechCrunch Disrupt Startup Battlefield, beating nearly 200 competitors. Its GliderM vehicle, a hybrid-electric machine that autonomously lifts and hauls 20-foot shipping containers focused on logistics, not passengers. The startup’s approach demonstrates how automation is extending beyond cars into the freight and supply chain ecosystem. In short, while Uber and Waymo fight for passengers, Glīd targets the docks.

The use of AI underpins all these advances. Nuro’s technology processes real-time data for navigation and hazard avoidance, aiming to reduce accidents and improve traffic efficiency. As these systems learn from millions of road scenarios, they could surpass human safety levels. But trust remains fragile.

Waymo’s head start sets a high bar. It operates commercial robotaxi fleets in San Francisco, Los Angeles, Phoenix, Austin, and Atlanta, and plans to expand into more cities by 2026. Its vehicles, primarily Jaguar I-PACE EVs, have logged millions of miles without major incidents. By contrast, Uber’s upcoming fleet must not only match this performance but convince regulators and users that premium autonomy is worth the price.

The broader picture is a market in transition. Uber’s re-entry into autonomy suggests the company now views driverless transport as essential to its profitability. Labour costs, insurance, and vehicle downtime make human-driven rides expensive to scale. Automation, if proven safe and efficient, could reshape Uber’s margins and even its business model. Yet, as the company shifts from gig economy reliance to robotics, it faces the paradox of disrupting the very workforce that built its success.

San Francisco’s streets will once again serve as the proving ground for the future of urban mobility. Whether Uber’s Lucid-Nuro alliance can match Waymo’s maturity or deliver a smoother passenger experience will determine how fast the market moves from pilot to mainstream. Either way, this launch marks a decisive phase where hype gives way to fleet-scale reality. The question now is less about technology and more about policy: will cities treat autonomous mobility as a public infrastructure priority or as a corporate experiment waiting for regulation to catch up?