The South African automotive landscape has undergone a seismic shift in 2025, defined largely by the aggressive and successful expansion of Chinese manufacturers. No longer relegated to the fringes of the budget sector, brands like Chery, Haval, and GWM have matured into dominant market players, fundamentally reshaping buyer expectations. This transition is not merely about affordability; it represents a strategic overhaul where technological sophistication meets aggressive warranty structures, challenging the historical dominance of European and Japanese giants.

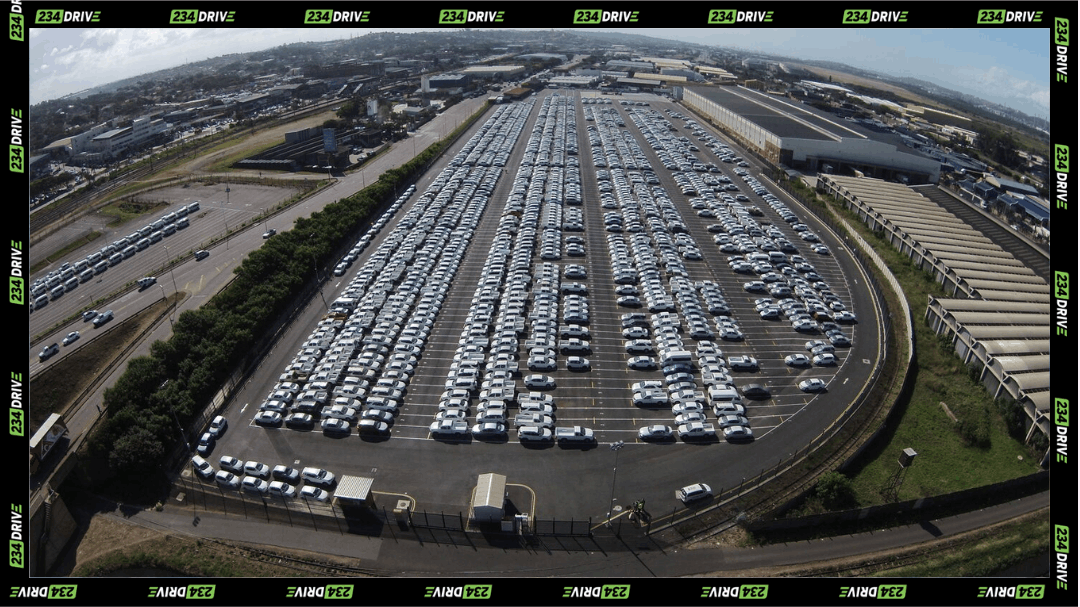

The “career” of these brands in South Africa has been one of resilience and rapid evolution. Overcoming early perceptions of inferior quality from the early 2000s, they have established a formidable public image centered on value and modernity. By late 2025, Chinese vehicles captured an estimated 12-13% of the passenger car market, a testament to their growing acceptance. This surge is driven by a clear understanding of the local consumer’s needs balancing the economic strain of rising fuel costs with a desire for premium features positioning them as the new heavyweights in the industry.

Chery Tiggo 4 Pro

The Chery Tiggo 4 Pro has established itself as the aesthetic benchmark for the compact SUV segment. Its design language is confident without being ostentatious, featuring a diamond-patterned grille that gives it a distinct face on South African roads. The muscular stance, accentuated by prominent wheel arches and LED daytime running lights, provides a road presence that belies its compact dimensions. It strikes a balance between rugged utility and urban sophistication, appealing to a demographic that values style as much as substance.

Inside, the Tiggo 4 Pro punches significantly above its weight class. The cabin is dominated by a large infotainment system that supports modern connectivity standards, a feature often reserved for more expensive vehicles. Under the bonnet, the performance is spirited, with turbo-petrol options delivering reliable power for both city commutes and highway cruising. The introduction of hybrid powertrains, boasting fuel efficiency figures as low as 5.4L/100km, addresses a critical pain point for local drivers. With a starting price around R269,900, it offers a compelling package of comfort and sales records prove its popularity, with units moving faster than major competitors.

Haval Jolion

Haval’s Jolion is arguably the most recognizable Chinese SUV on local streets, replacing the popular H2 with a bolder, more futuristic design. The front fascia is dominated by a mesh grille and vertical lighting signatures that make it instantly identifiable in rear-view mirrors. Its proportions are generous for its class, offering a substantial footprint that translates to a feeling of safety and solidity. The design choices reflect a deliberate move towards a more premium aesthetic, distancing the brand from its utilitarian roots.

The interior of the Jolion is a showcase of digital integration, featuring a rotary dial shifter and a floating touchscreen that manages most vehicle functions. While some critics note the lack of physical buttons, the clean, minimalist layout is undeniable. Performance-wise, the Jolion feels planted and capable, with hybrid variants adding a layer of refinement and efficiency essential for the stop-start nature of urban traffic. Pricing starts around R300,000, and its success is evident, being the most popular Chinese car in various quarterly reports, moving thousands of units effortlessly.

Omoda C5

As a style-focused sub-brand, the Omoda C5 breaks away from traditional SUV styling cues. It features a “borderless” grille and a fastback silhouette that prioritizes aerodynamics and visual drama. The split headlight design and sharp geometric lines create a polarizing but undeniably modern look that appeals to younger buyers. On the road, it looks like a concept car brought to life, standing out starkly against the more conservative designs of its segment rivals.

The cabin of the Omoda C5 is designed to feel like a cockpit, wrapping the driver in high-quality materials and dual integrated screens. It is packed with Advanced Driver Assistance Systems (ADAS), including voice control and adaptive cruise control, which are standard even in lower trims. The driving dynamics are tuned for sportiness, although the suspension can be firm on uneven surfaces. Priced from R400,000, it positions itself as a tech-savvy fashion statement, achieving significant sales figures despite being a relative newcomer.

Jetour Dashing and X70 Plus

Jetour, focusing on the “Travel+” philosophy, brings a robust and adventurous aesthetic to the market. The Dashing model lives up to its name with sharp, aggressive lines and flush door handles that add a touch of luxury. The larger X70 Plus offers a more traditional but commanding SUV profile, emphasising length and interior volume. These vehicles are designed to look substantial, projecting an image of durability and capacity that resonates well with family-oriented buyers.

Practicality is the hallmark of the Jetour range, particularly with the X70 Plus offering seven-seat configurations—a rarity at its price point of roughly R350,000. The interiors are spacious, ensuring comfort for long-distance travel, supported by engines that are backed by an impressive 10-year/1-million km warranty. While the ride quality may not match the plushness of premium German rivals, the value proposition of space and tech is unmatched. This practical focus has helped Jetour become one of the Top 5 Best-Selling Chinese Car Brands in SA, experiencing explosive growth in a short period.

GWM P-Series

The GWM P-Series bakkie has disrupted a segment traditionally held by the Toyota Hilux and Ford Ranger. Its design is imposing, featuring a massive chrome grille and a high bonnet line that exudes strength. It looks every bit the workhorse it is designed to be, yet maintains enough refinement to serve as a lifestyle vehicle. The sheer size of the P-Series gives it immense road presence, demanding respect in traffic and fitting perfectly into South Africa’s bakkie-loving culture.

Inside, the P-Series surprises with a level of luxury uncommon in utility vehicles, including quilted leather seats and soft-touch materials in higher trims. It offers robust towing capacity and off-road capability, making it suitable for both farm work and weekend escapes. While the non-hybrid engines can be thirsty, the introduction of newer powertrain options is mitigating this issue. Starting at R400,000, it offers a level of equipment that competitors struggle to match at the same price point, cementing GWM’s status in the commercial sector.

Relevance to the South African Driving Environment

The rapid adoption of these Chinese brands is not accidental; it is deeply rooted in the specific realities of the South African motoring environment. South African roads are notoriously variable, ranging from smooth highways to pothole-riddled suburban streets and unpaved rural tracks. The preference for SUVs and high-riding vehicles offered by Chery, Haval, and Jetour is a direct response to these conditions. The increased ground clearance and robust suspension systems of models like the GWM P-Series and Tiggo 8 Pro provide the durability and confidence drivers need to navigate deteriorating infrastructure. Furthermore, the inclusion of full-size spare wheels in many of these models demonstrates an understanding of local needs that some European manufacturers have neglected.

Economically, the relevance is even more pronounced. With the cost of living soaring and interest rates remaining high, the “value-for-money” proposition is the primary driver of sales. South Africans are lifestyle-oriented drivers who demand connectivity and comfort for long commutes and holiday travel. Chinese brands have tapped into this by offering “fully loaded” vehicles where features like sunroofs, leather seats, and 360-degree cameras are standard rather than expensive options. The expansion of dealer networks into smaller towns also addresses the critical issue of maintenance availability, reassuring buyers that support is accessible beyond the major metros.

Market Comparison and Competitor Analysis

When compared to traditional market leaders, Chinese brands offer an undeniable price advantage, typically undercutting rivals by 20-30%. For instance, a similarly specced Toyota or Volkswagen would cost significantly more than a top-tier Haval or Chery. However, the trade-off has historically been resale value. Established brands like Toyota generally retain their value better over time due to decades of trust and perceived reliability. While Chinese brands are making waves and improving in this regard, they still face higher depreciation rates. A buyer must weigh the immediate saving on the purchase price against the potential lower trade-in value three to five years down the line.

In terms of durability and maintenance, the gap is closing. The introduction of extensive warranties up to 10 years in some cases is a strategic move to counter skepticism regarding long-term reliability. While parts availability can still be a bottleneck compared to the ubiquitous support for a VW Polo or Toyota Corolla, the aggressive expansion of parts warehouses by Chery and Haval is mitigating this risk. As the big six auto brands dip below 50% market share, it is clear that for many South Africans, the immediate benefits of a feature-rich, affordable vehicle outweigh the traditional safety of established marques.

Conclusion

The rise of Chinese car brands in South Africa is a story of strategic triumph and market adaptation. By offering vehicles that combine desirable aesthetics, high-end technology, and practical durability at an accessible price point, brands like Chery, Haval, and GWM have successfully challenged the status quo. Their collection of vehicles—from the stylish Omoda C5 to the rugged GWM P-Series offers something for every sector of the market, proving that they are here to stay.

As these manufacturers continue to refine their offerings and expand their local footprint, the South African consumer stands to benefit the most from increased competition and choice. Whether you are a skeptic or a convert, the impact of these vehicles on our roads is undeniable. We invite you to share your thoughts: have you made the switch to a Chinese brand, and if so, how has the ownership experience been for you?