The roar of the combustion engine has returned to the heart of Michigan. At the 2026 Detroit Auto Show, the North American automotive industry signalled a definitive retreat from the aggressive electric-only mandates of the previous decade, choosing instead to prioritise high-performance hybrids and traditional internal combustion power. This strategic U-turn follows a dramatic year in which federal policy reversals and the expiration of buyer incentives caused the spotlight dims for electric vehicles, forcing manufacturers to recalibrate their multi-billion-pound investment strategies.

The North American International Auto Show, held this January at Huntington Place, served as the primary stage for this industrial realignment. Major manufacturers including Ford, GM, and Stellantis showcased a “consumer choice” model, reintroducing dedicated floor space for petrol-powered trucks and SUVs that had previously been sidelined. This trend was foreshadowed by the 2025 LA Auto Show, where initial signals of buyer fatigue regarding pure electrification first became prominent. This pivot is largely a reaction to a 40% drop in electric vehicle registrations following the removal of federal tax credits in late 2025, which has left dealerships across the United States struggling to move battery-electric inventory.

A key driver of this shift is the federal affordable cars initiative, which has fundamentally reset the regulatory landscape for American manufacturers. By lowering corporate average fuel economy targets to roughly 34.5 miles per gallon by 2031, regulators aim to cut manufacturing compliance costs and potentially save consumers up to $1,000 per new vehicle. Proponents of the move argue that it eliminates “backdoor mandates,” though many analysts warn that thefuel economy rollback creates fresh uncertainty for firms that have already committed their global budgets to total decarbonisation.

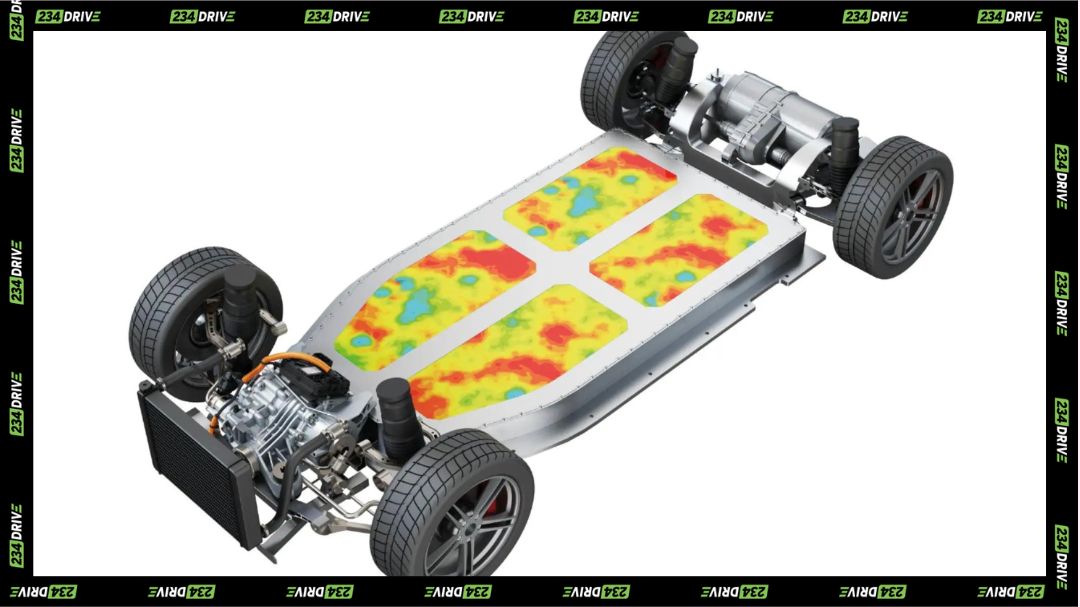

Despite the softening demand for pure electric models, technological innovation has not stalled; rather, it has shifted focus towards efficiency and safety. Recent battery technology research highlights how artificial intelligence is being integrated to optimise energy usage in hybrid systems. However, the industry is also facing heightened regulatory scrutiny following high-profile safety incidents involving autonomous technologies. These concerns have reinforced the market’s current preference for refined, driver-centric internal combustion and hybrid systems over fully automated, battery-dependent alternatives.

In a move that epitomises this traditionalist resurgence, Stellantis has announced a massive Hemi production surge for its 2026 model year. The company plans to triple its output of V8 engines to over 100,000 units to satisfy a significant spike in orders for Ram trucks and Jeep Wranglers. This focus on long-term durability and mechanical power reflects a broader consumer return to trusted engineering, often seen in the ongoing debates regarding Toyota versus Honda reliability standards. This decision highlights a growing divergence in global markets: while Europe and China continue to accelerate towards zero-emission transport, the North American market is doubling down on high-margin, high-displacement engines.

The roles in this new era are clearly demarcated: manufacturers supply the high-displacement engines the public demands, while industrial partnerships such as the Mitsubishi Fuso collaboration focus on improving commercial vehicle efficiency through modular design. Meanwhile, the government provides the regulatory breathing room to lower costs, and technology firms provide the AI optimisations to keep these vehicles efficient enough for the modern era. This represents a shift from a mandate-driven market to one defined by immediate consumer preference and short-term affordability.

Ultimately, the events in Detroit suggest that the transition to a greener fleet will be a marathon rather than a sprint. While the return to V8 power may solve immediate sales challenges and affordability concerns, it raises significant questions about the long-term competitiveness of US manufacturing on the world stage. Should regulators treat the current charging infrastructure gap as a failure of the technology, or should they view the hybrid pivot as the only sustainable path forward? The industry now waits to see if this fossil-fuel revival is a permanent fixture or a brief detour on the road to a different future.