The best time to buy that car was yesterday!

With a new administration comes new policies, policies that have put various industries in the country in shambles over the years, and the automobile industry has had its amicable share of this misfortune. The devaluation of the Nigerian Naira is driven by fluctuating oil prices, Central Bank poor policies, high inflation, and persistent dollar demand for imports. Structural issues like economic dependence on oil, lack of diversification, political instability, and corruption have further weakened the Naira. Global events, such as the COVID-19 pandemic, have also exacerbated the situation. These factors have significantly disrupted the automobile market, underscoring the urgent need for comprehensive economic reforms to stabilize the currency and support industry growth.

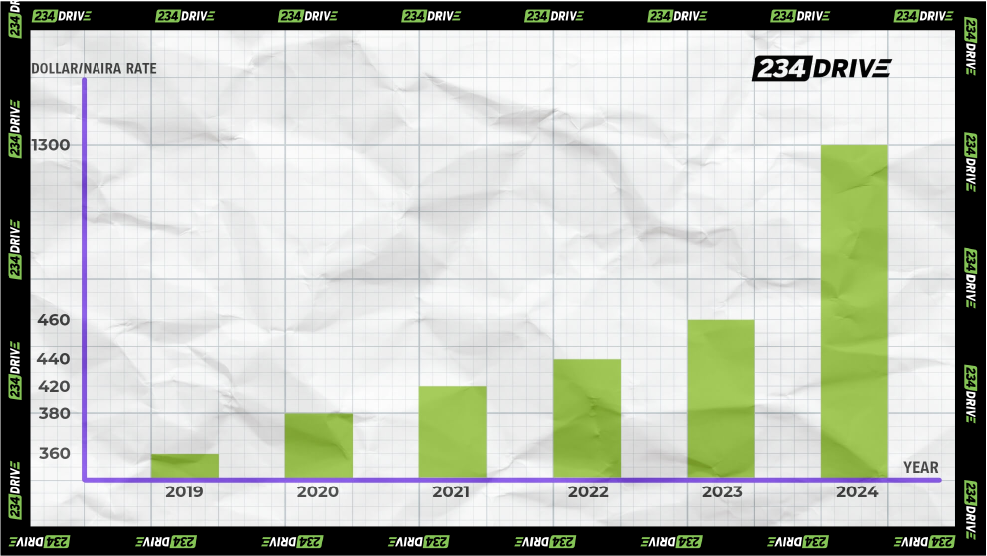

Since 2018, the Naira’s value against the US Dollar has seen significant fluctuations. Starting at an official rate of around 305 NGN/USD and parallel rates of 360-370 NGN/USD, the currency faced further depreciation during the COVID-19 pandemic in 2020, reaching 360 NGN/USD officially and over 450 NGN/USD in the parallel market. By 2021, the official rate adjusted to 411 NGN/USD, with parallel rates surpassing 500 NGN/USD. Continued devaluation led to a rate of 415 NGN/USD in 2022 and about 632 NGN/USD by mid-2023, stabilizing briefly before climbing to 1474 NGN/USD by June 2024 after implementing a unified foreign exchange market. The sources for this information include the Central Bank of Nigeria and Nairametrics.

These statistics highlight the unpredictable nature of Naira rates, influenced by various economic factors and policy changes. Just as weather patterns fluctuate unpredictably, so too does the value of the Naira.

If I’m to highlight a common characteristic of Nigerians, it’s going to be their ability to adapt to economic changes swiftly. However, this doesn’t mean you should go about pushing them to the wall, because they also have another common trait; bringing out the inner agbero (thug) in them when needed. So, beware. All the prices of fuel, transport fares, cars, and even spare parts have doubled, if not tripled, over the years. It’s no longer a shock to buy something today for ₦50k and go back a few months later to find out it’s now ₦120k. If you ask for the reason behind the new price, you’ll hear things like “dollar ti won” (the dollar is expensive). Hesitating to buy will only lead to regret because when you check back again, the price is probably close to ₦150k now. In this type of economy, delay is denial, and that’s why the best time to buy that car or spare part is today. By tomorrow, the rates will have gone up.

Purchasing a brand new car now with the current dollar rate is definitely costing an arms and a leg and who wants to be amputated, when you can just trek. Only the affluent or rich kids can afford to buy brand new cars in this current economic climate. The prices of new cars in the country have surged by 50% due to the dollar rates, as dealers are afraid of losing profit, causing prices to skyrocket. This scenario not only discourages people from buying cars but has also led to a decrease in the number of new cars being imported. Import duty for vehicles, which was about 35% of the vehicle’s worth, was calculated at 422.30 naira to the dollar. However, from the 26th of June 2023, the official rate was increased to 589.45 naira to the dollar, resulting in a whopping 40% increase in import duty.

Even though this might unfurl some bad memories of your high school or university exams, let’s do some math! For example, let’s say a vehicle is worth $10,000 USD (you’re buying from the US, so you pay using the official dollar/naira rate, which as of writing this article on June 8, 2024, is 1 USD ⇛ ₦1,498.741).

Before June 26th, 2023:

- Import duty: 35% * $10,000 USD = $3,500 USD

- Exchange rate: 422.30 Naira/USD

- Duty amount in Naira: $3,500 USD * 422.30 Naira/USD = 1,478,050 Naira

After June 26th, 2023:

- Import duty: 35% * $10,000 USD = $3,500 USD

- Exchange rate: 589.45 Naira/USD (approx.)

- Duty amount in Naira: $3,500 USD * 589.45 Naira/USD = 2,063,075 Naira

As you can see, there is an increase in the total amount you pay in Naira due to the exchange rate, even though the import duty rate of 35% hasn’t changed.

In scenarios like this, the typical reaction would be for consumers to shift towards more viable and affordable options. Surprisingly, this time, most Nigerians folded and complied with the law of economics, no more swift adaptation. As the automobile industry crumbled due to high prices on almost every new item, everyone flocked to the Tokunbo car market (foreign used car market). Consequently, prices for Tokunbo cars and parts have also increased due to high demand. Now, much like returning to an ex, we’ve migrated to the Nigerian used car market, as these cars are much cheaper than their counterparts (new and Tokunbo cars). It seems we’ll be stuck with the same car models on our roads for some time.

In summary, the Nigerian economy, especially the automobile industry, has been challenged by fluctuating Naira rates and policy changes over the past decade. Rising prices of new and Tokunbo cars have shifted consumer focus to the Nigerian used car market. This trend may lead to long-term dominance of the Nigerian used cars in the market. Urgent economic reforms are needed for stabilizing the Naira and fostering sustainable growth across industries.