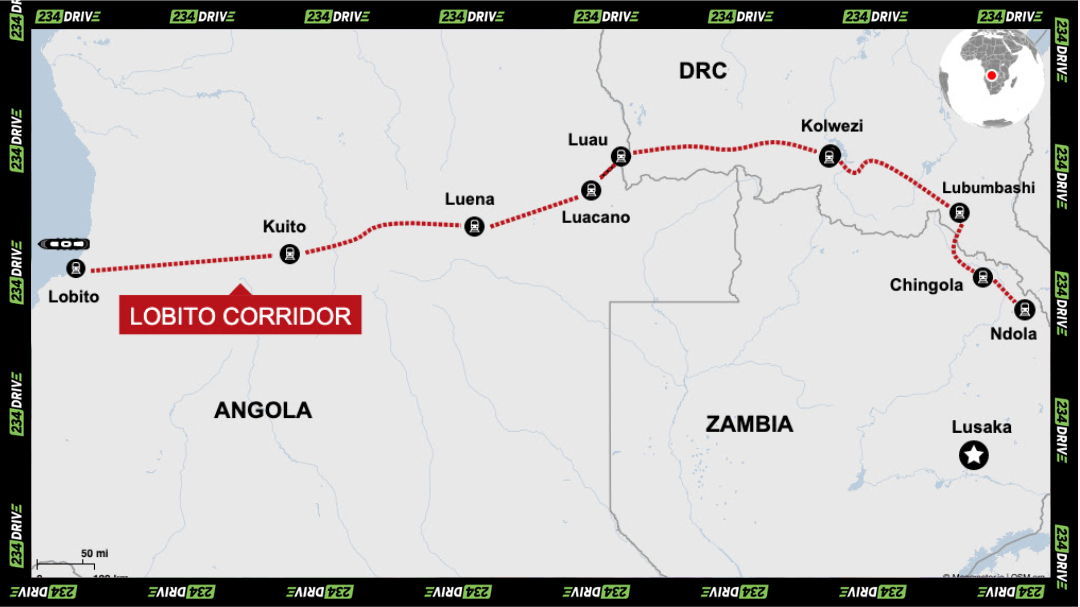

Map illustrating the Lobito Corridor railway linking Angola’s port of Lobito with key mining centres in the DRC and Zambia. | Source: Chinaglobalsouth

A $753 million financing package has locked in the upgrade of the Lobito Atlantic Railway, positioning the corridor as one of Southern Africa’s most strategic rail infrastructure projects for trade and critical minerals. The deal brings together development finance from Southern Africa and the United States, signalling renewed momentum behind rail-led Africa mobility at a time when governments are prioritising resilient supply chains.

The project will rehabilitate a 1,289-kilometre railway linking Angola’s Atlantic port to the Democratic Republic of Congo (DRC), drastically expanding freight capacity and cutting mineral transport costs.

The Lobito Atlantic Railway and Why It Matters

The Lobito Atlantic Railway concession focuses on rebuilding the Benguela Railway from the Port of Lobito to Luau at the DRC border. The upgrade targets tracking, signalling, workshops, and rolling stock to create a reliable intermodal route for copper and cobalt exports from Central and Southern Africa. Once complete, the corridor is expected to lift annual capacity to 4.6 million tonnes and reduce logistics costs for critical minerals by as much as 30%, strengthening the continent’s mobility and export competitiveness.

By shortening the travel time to tidewater and improving reliability, the rail corridor aims to weave inland mining regions more tightly with global markets while supporting intra-African trade. The project’s backers frame it as infrastructure that would serve both regional development and the global energy transition.

$753 Million Secured to Move the Lobito Corridor From Plan to Execution

Current financing totals $753 million, the majority of which is led by $553 million in senior debt from the U.S. International Development Finance Corporation and a $200 million commitment from the Development Bank of Southern Africa. The concessionaire, Lobito Atlantic Railway, operates under a 30-year agreement and is owned by a consortium comprising Trafigura, Mota-Engil, and Vecturis. The signing in Washington, DC, marks the most concrete step yet after years of planning.

Despite Logistics and Geopolitical Hurdles, the Lobito Corridor Remains Workable

While financing is secured, execution still faces familiar cross-border challenges. The corridor requires tight operational and security coordination between Angola and the DRC, particularly along sensitive border sections. Brownfield rehabilitation adds further risk, as upgrades must proceed while services continue and port capacity at Lobito scales in step with rising rail throughput.

The project also sits within broader geopolitical tension. Some observers frame the Lobito Corridor as a direct challenge to China-backed transport routes in Central Africa, adding diplomatic and strategic scrutiny. Additionally, in the DRC, sections of the rail upgrade have raised concerns around land use and the potential displacement of communities along the existing rail path, increasing the need for careful resettlement planning and stakeholder engagement. These structural and political factors are not new, but they will surely influence delivery timelines, costs, and long-term returns for railway infrastructure projects this large in Africa.

Africa’s Wider Rail Moment in Mobility and Trade

Lobito’s progress aligns with major rail investments elsewhere. 234Drive also covered Egypt’s rollout of Siemens-built Velaro high-speed trains as part of a 2,000-kilometre national network designed to cut travel times and expand freight capacity by over 40%. In a network estimated to cover 90% of the population. The scale and pace of Egypt’s programme demonstrate how rail can anchor national infrastructure strategies when funding, execution, and political backing align.

Nigeria has outlined plans for long-distance rail modernisation, including high-speed concepts, but delivery remains patchy. For now, the Lobito Corridor stands as one of the clearest tests of how strategic financing can turn that ambition into operating infrastructure.