Nigeria’s automotive landscape is undergoing a quantifiable shift, evidenced by a documented 400 per cent increase in electric vehicle (EV) adoption between 2020 and 2025. This surge, highlighted recently by government officials and industry data, marks a definitive move from speculative interest to tangible market penetration. While the starting baseline was low, the presence of approximately 20,000 EVs on Nigerian roads by early 2026 signals that e-mobility is establishing a foothold, particularly in major urban centres like Lagos and Abuja. This growth is not accidental; it is the result of a convergence between economic pressure on petrol prices and a concerted effort to establish domestic industrial capacity, moving the conversation from mere importation to sustainable local value creation.

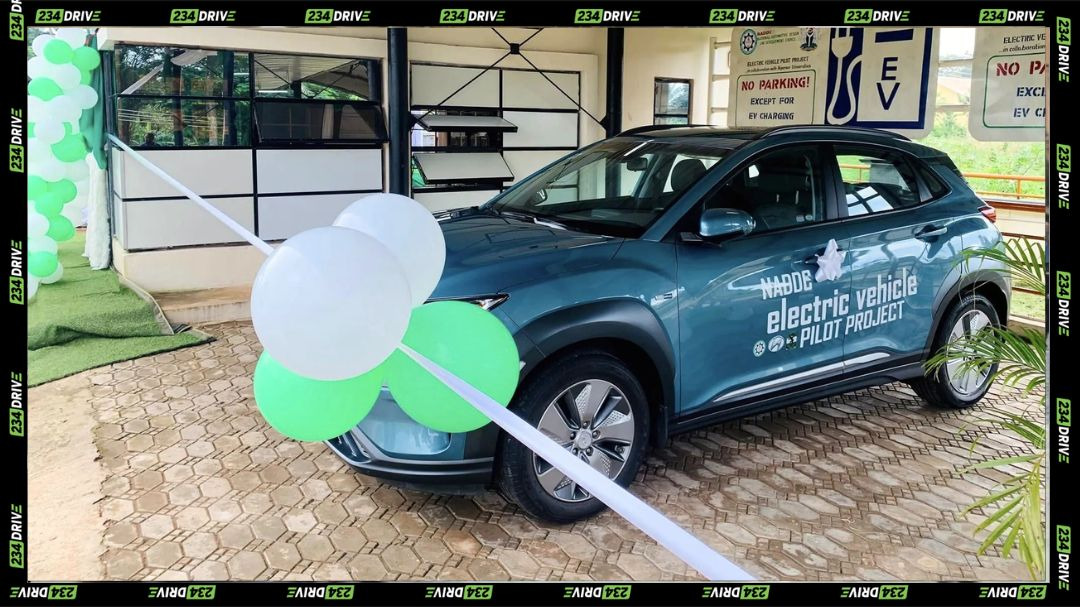

The primary catalyst for this expansion is the rise of local manufacturing, spearheaded by players such as SAGLEV. By establishing dedicated assembly plants, such as the facility in Imota, Ikorodu, these manufacturers are addressing the unique challenges of the Nigerian market with vehicles built to withstand local road conditions. This shift towards domestic assembly is critical; it reduces the reliance on fully built-up imports and ensures the availability of spare parts and technical support, which have historically been major barriers to entry for new automotive technologies. The industry is seeing a transition where vehicles are not just landing at the ports but are rolling off local production lines, supported by the National Automotive Design and Development Council (NADDC) as part of a broader industrial revolution.

Supporting this industrial push is the Electric Vehicle Transition and Green Mobility Bill of 2025, which has provided the necessary regulatory framework to de-risk investment in the sector. The legislation introduces specific incentives, including VAT waivers and tax holidays, while simultaneously mandating the installation of charging infrastructure at fuel stations nationwide. This policy approach aims to solve the “chicken and egg” problem of infrastructure versus vehicle availability. By enforcing a 30 per cent local content requirement, the government is also signalling a long-term strategy to retain economic value within the country, ensuring that the shift to electric transport translates into job creation and technical skills transfer rather than just a change in consumption habits.

The commercial transport sector has emerged as the most aggressive driver of this adoption curve, prioritising operational costs over novelty. For ride-hailing drivers and logistics operators, the volatility of petrol prices—often pushing daily fuel expenses to between N18,000 and N20,000—has made the switch to electric vehicles a financial imperative rather than an environmental choice. Data indicates that these commercial operators are achieving operational savings of 50 to 70 per cent, validating the economic use case for EVs in a high-inflation environment. This segment acts as the proving ground for the technology, demonstrating reliability and gradually building consumer confidence for broader private adoption.

Despite these advancements, the sector faces distinct hurdles as it scales from 20,000 units to a mass-market alternative. The growth rate, while impressive in percentage terms, still represents less than one per cent of the total vehicle fleet, highlighting the dominance of internal combustion engines. The trajectory of this transition now depends heavily on the successful expansion of charging networks and the stability of the power grid. As manufacturers like SAGLEV continue to ramp up production and Chinese entrants introduce price-competitive models, the focus will likely shift to how effectively the grid can support this new demand, determining whether this 400 per cent growth is a momentary spike or the beginning of a permanent restructuring of Nigeria’s transport sector.