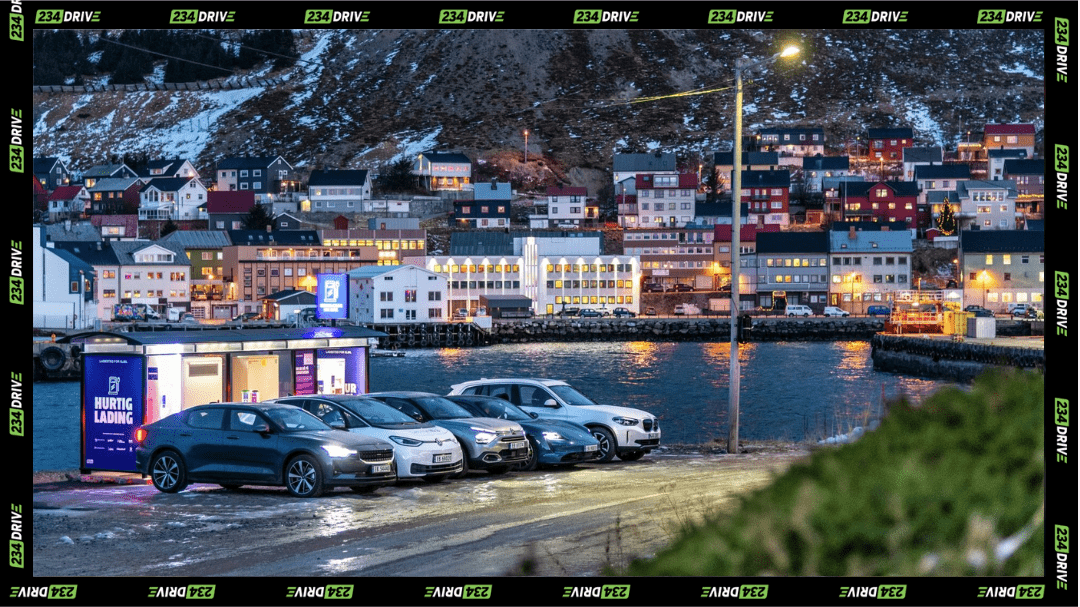

A glimpse of Norway’s electric shift, where EVs now feel like the default choice. | Source: elbil

While most of Europe, the U.S., and much of the world continue to wrestle with uneven electric-vehicle adoption, Norway makes the shift look almost effortless—so much so that if countries were graded on their EV transition, Norway would be sitting comfortably in the A+ range.

In 2025, electric vehicles accounted for 95.9% of all new passenger cars registered in the country, according to official registration data. By December, that share climbed to nearly 98%, leaving petrol and diesel cars as little more than single-digit statistical footnotes in the new-car market. In total, Norway registered 179,549 new cars during the year, a 40% jump from 2024, with nearly all of that growth driven by fully electric models.

Now, this didn’t happen overnight or due to some luck factor other countries lack. Norway’s EV dominance is the product of long-term policy choices that steadily tilted the market. Instead of outright bans, authorities relied on a predictable mix of incentives and penalties: generous tax breaks for EVs, higher fees for combustion vehicles, and consistent support for charging infrastructure. In time, that approach reshaped buying habits, so much so that when 2025 arrived, the electric option was the cheaper and most practical choice.

An incoming policy shift also helped push numbers higher. The government confirmed that a value-added tax of up to roughly $5,000 would apply to some EV purchases from January 2026. That announcement triggered a year-end buying rush, with consumers, dealers, and automakers pulling deliveries forward to beat the deadline. Several manufacturers reportedly redirected vehicles from other European markets into Norway to meet the surge in demand.

Which Carmaker Sold the Most EVs in Norway in 2025?

At the brand level, Tesla had another record-breaking year. The company captured 19.1% of all new registrations, selling more than 27,000 vehicles—the highest annual total ever achieved by a single automaker in Norway. Strong demand for the Model Y and confidence in Tesla’s charging network kept the brand on top, even as it saw softer sales trends elsewhere in Europe. Still, competition tightened, with Volkswagen and Volvo continuing to close the gap in key segments.

Beyond Western brands, Chinese manufacturers quietly expanded their footprint. Companies such as BYD helped lift China’s combined market share to about 13.7% in 2025, up from 10.4% a year earlier. While tariffs and trade scrutiny complicate their European push, these same manufacturers are accelerating into Africa and other emerging markets, where competitively priced EVs and hybrids are making electrification more accessible.

Petrol and diesel cars haven’t vanished entirely from Norwegian roads, but their role is shrinking fast. In the new-car market, at least, the transition is no longer theoretical. Norway has already crossed the line that the majority of Europe and the world are debating.