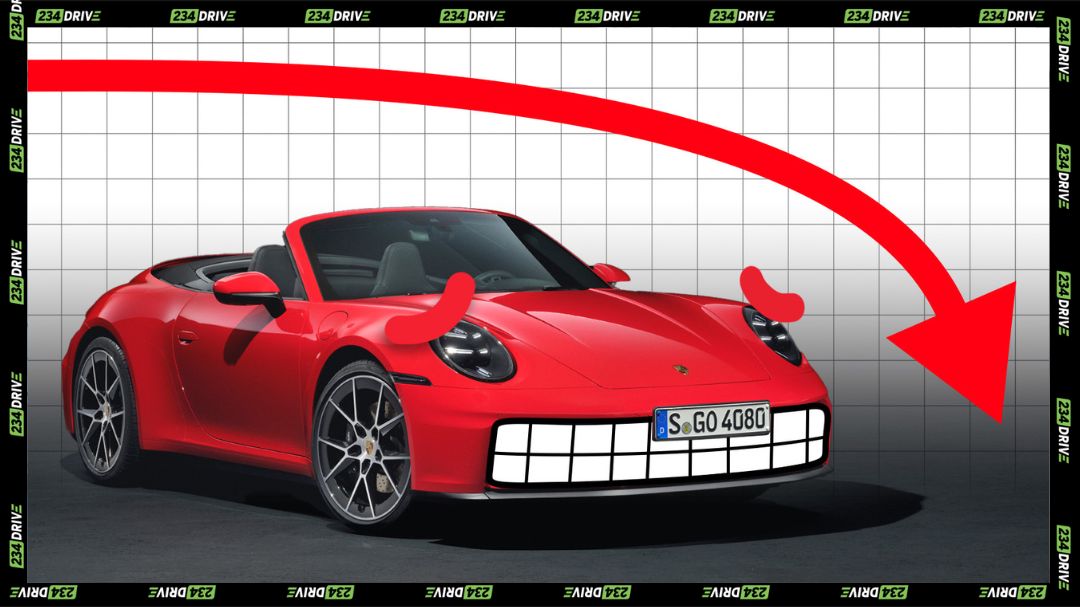

Porsche AG’s near-century-scale earnings wobble — a 95.9% drop in net profit to €114 million in the first nine months of 2025 — is more than a quarterly headline: it’s a signal flare for an industry in transition. The gamble of shifting heavy capital into an electric future, then retrenching when demand didn’t follow, produced €3.1 billion in one-off costs that have swallowed what were once strong margins and turned a growth story into a strategic reset.

At the centre of the shock are three interlinked forces: costly strategic pivots, policy and tariff shocks, and intensified competition in the luxury EV arena. Porsche booked large impairments after delaying all-electric model launches, scrapped planned battery expansions, and absorbed steep U.S. import tariffs moves that combined to turn operating profitability from robust to fragile almost overnight. The company’s cautious rebalancing toward combustion and plug-in hybrids reflects hard lessons about timing and customer readiness for BEVs.

China’s dramatic demand shift hit Porsche where it counts. Deliveries there plunged over 25%, and Europe also softened, while North America held up. For a brand that relies on premium positioning and aspirational pricing, losing share in the world’s largest auto market exposes both volume and margin vulnerabilities, forcing network rationalisations and staffing adjustments to align cost base with a smaller-than-expected BEV contribution.

But the story isn’t only about external rivals. Porsche’s internal choices — ramping BEV spend in expectation of faster adoption and then scaling back — generated headline-sized write-offs. These impairments and halted projects illustrate a wider industry problem: legacy automakers must balance long-term transition bets with near-term consumer realities and regulatory pressures, and getting that balance wrong can be ruinous to quarterly economics.

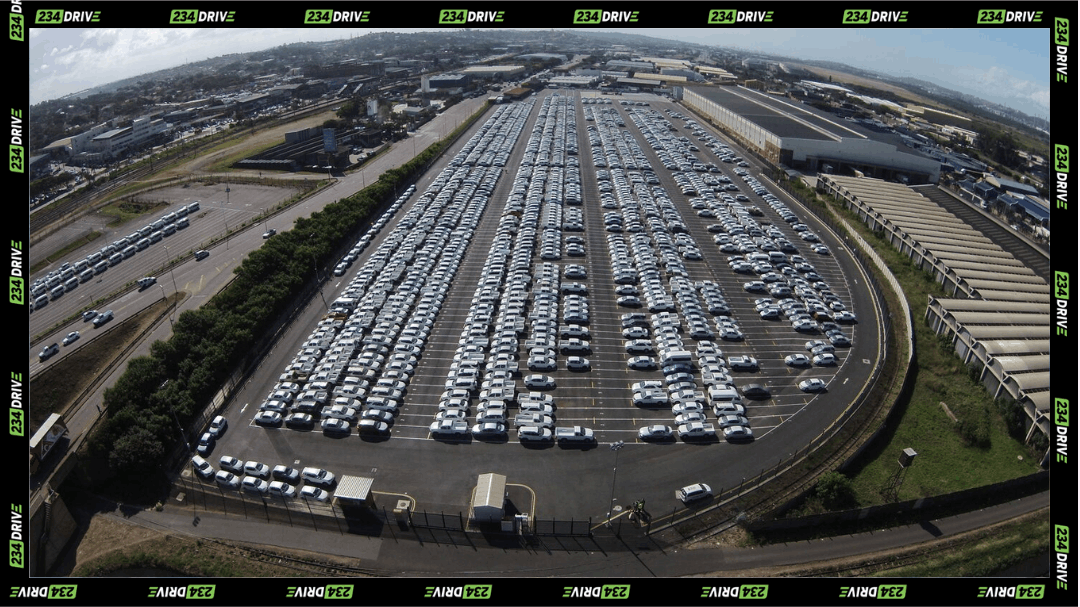

The South African angle turns abstract financials into local livelihoods. SA’s car industry, heavily tied to European assembly lines and exports, is already feeling competition from an influx of Chinese-built vehicles that are competitively priced and feature-rich. As Chinese brands push into African markets, value-conscious buyers in SA are re-evaluating brand hierarchies, which compresses demand for imported luxury models and complicates assembly and export plans that depend on steady volumes from brands like Volkswagen Group.

On-ground effects in SA could include further dealership consolidation, pressure on locally sourced supplier work, and, in the worst-case scenario, job cuts if assembly volumes decline. The “bloodbath” rhetoric reflects legitimate anxiety: rapid market share shifts, especially when concentrated in imported segments, can accelerate deindustrialisation in regions reliant on an older automotive value chain.

Yet the picture is not uniformly bleak. Porsche projects 2025 as a trough and expects margins to recover in 2026 as new models, tighter cost discipline and a more flexible product mix take hold. A pragmatic, mixed-powertrain roadmap — retaining combustion and hybrids alongside BEVs where consumer demand warrants — is their near-term response, and it’s an approach other premium makers may emulate to reduce exposure to single-technology risk.

Policy action and industrial strategy will shape how the SA story plays out. Targeted incentives for local production, calibrated tariffs, or investment in charging infrastructure and EV value chains could blunt the worst impacts of rapid import competition. But these interventions take political will and budgetary clarity; absent them, local players may struggle to compete with scaled Chinese production and aggressive pricing.

Ultimately, Porsche’s Q3 message is a cautionary tale: transition timing matters as much as technology choice. The collision of expensive strategic U‑turns and nimble rivals created a perfect storm that exposed structural risks for legacy automakers — and for economies that depend on them. For South Africa, the next 12–24 months will reveal whether policy adjustments and local industry responses can soften the blow or whether the ‘bloodbath’ becomes a longer-term reconfiguration of the region’s automotive footprint.

If nothing else, the episode forces a strategic rethink: legacy brands must get more surgical about when, where and how they invest in electrification, while policymakers and industry stakeholders need to coordinate to protect jobs and preserve productive capacity in affected regions.