In Shenzhen’s humming mega factories, a BYD electric vehicle rolls off the assembly line every 40 seconds. Across the Pacific, Tesla’s Cybertruck production in Texas accelerates under the protective shield of $1.5 billion in CHIPS Act subsidies. Meanwhile, in the mineral-rich heart of Africa, trucks laden with cobalt—over 70% of the world’s supply—rumble toward Chinese-owned processing plants, their precious cargo destined to power foreign-made batteries.

This is the 21st century’s defining geopolitical battle, fought not with tanks but with trade policies, not with missiles but with minerals. As China and America lock horns over semiconductors, rare earth elements, and AI supremacy, Africa stands at the most consequential crossroads of all: Will it remain a pawn in this great game, or emerge as the architect of its own mobility revolution?

THE EV ARMS RACE GOES GLOBAL

The numbers tell a story of tectonic shifts. In 2023, BYD’s stunning sales figures—3.02 million EVs globally—dwarfed Tesla’s 1.8 million, signaling more than corporate competition. This was geopolitical realignment on wheels, with China now controlling 60% of global battery production through giants like CATL and BYD, and commanding 80% of rare earth processing. Africa finds itself caught in this crossfire, importing 70% of its EVs from China, while Western alternatives remain prohibitively expensive.

The American response has been swift and surgical. The 100% tariff on Chinese EVs imposed in May 2024 represents just one front in a broader campaign that includes $6 billion in subsidies for ‘friendly-shoring’ battery plants and cobalt supply deals with Zambia to bypass Chinese-controlled DRC networks. Europe struggles with compromise—20% tariffs on Chinese EVs while allowing BYD factories in Hungary. India takes a harder line with 30% local content requirements. But Africa, the final frontier in the global auto market, remains uniquely vulnerable to great power manoeuvering.

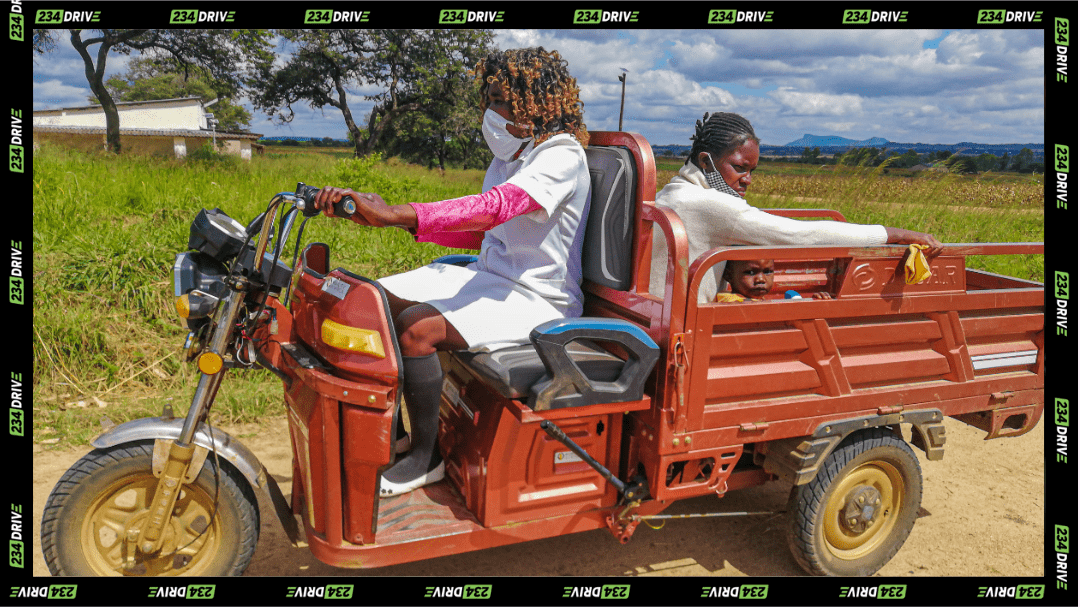

AFRICA’S MOBILITY DILEMMA

Walk through Lagos’ bustling car markets, and the affordability crisis is obvious.

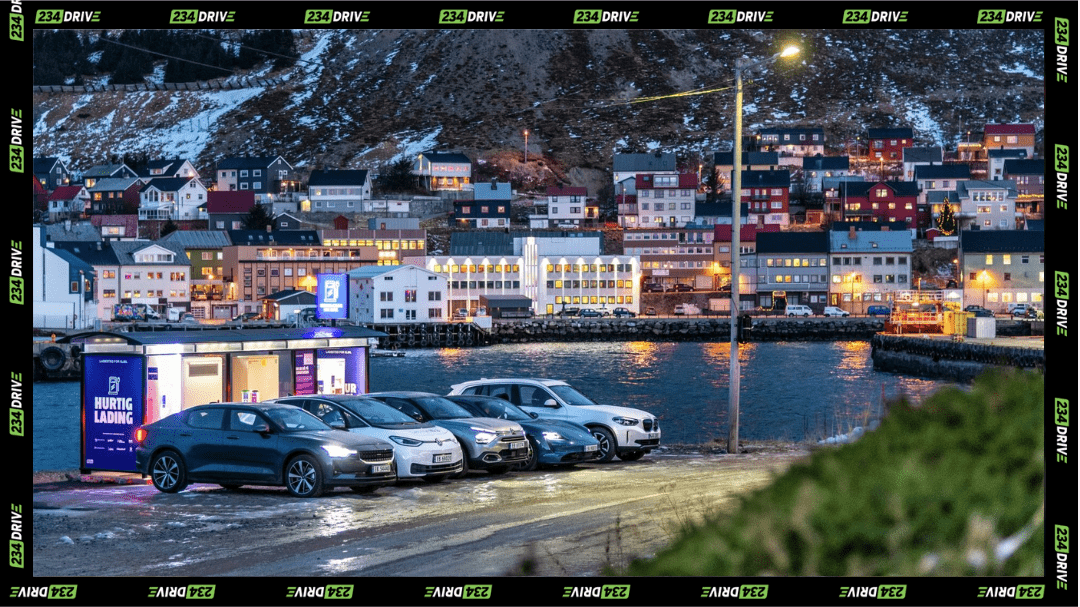

The infrastructure landscape reveals deeper dependencies. Kenya’s 1,000 km Mombasa-Nairobi charging corridor, built with Chinese technology, runs on Beijing’s software—each kilowatt-hour charged feeding valuable data back to servers in Shenzhen. Of the 18 African EV charging networks built since 2020, 15 bear Chinese fingerprints, compared to just three U.S.-backed projects. This isn’t development—it’s digital colonialism with charging ports.

Nowhere is the paradox more glaring than in the DRC’s cobalt mines. Children dig the mineral with bare hands just kilometers from Chinese processing plants that multiply its value fifteen fold—yet Africa captures barely 5% of final battery value (Cobalt Institute 2024). Of 19 major lithium-cobalt mines, 15 operate under Chinese control. Morocco’s $6.3 billion gigafactory, set to supply European automakers in 2026, stands as both inspiration and indictment—proof of what’s possible, and what’s being squandered.

GLOBAL PLAYBOOKS

Europe’s precarious balancing act—allowing BYD factories while nurturing Northvolt—demonstrates the art of competitive coexistence. Thailand’s EV production surge from 5,000 to 250,000 units (2020-2024) shows how smart incentives can transform markets. But Chile’s lithium nationalization debacle stands as stark warning: sovereignty without technical capacity is mere symbolism.

AFRICA’S MOBILITY MANIFESTO

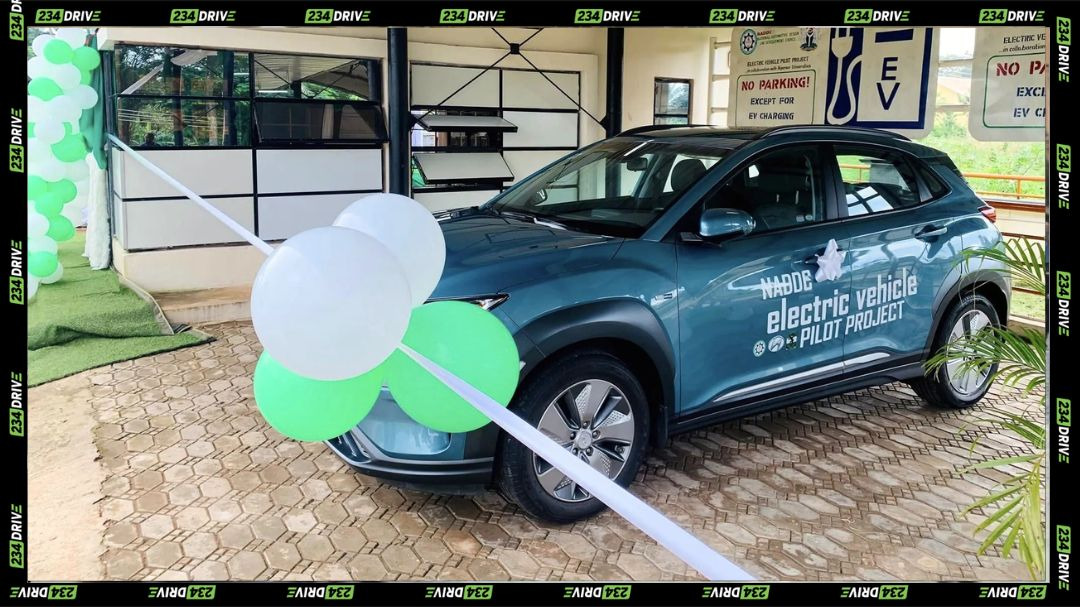

The path forward demands more than policy tweaks; it requires reinventing Africa’s relationship with technology powers. Nigeria’s 40% local content mandate must evolve beyond assembly lines to encompass real manufacturing—welding shops, paint booths, and eventually battery pack production. South Africa’s auto sector, contributing 4.3% to GDP, proves this model works when executed with graduated, enforced requirements.

Mineral wealth must become leverage, not liability. Zambia’s cobalt export ban forced Chinese processors onshore, creating 3,000 high-value jobs. A Pan-African Battery Alliance could unite the DRC’s cobalt, Zambia’s copper and Namibia’s lithium under shared industrial policies, mirroring Europe’s €20 billion Battery Alliance. Export taxes on raw ores should fund local refining—Morocco’s gigafactory proves the value proposition.

Kenya’s open-source mobility API offers a third way between digital empires, preventing lock-in to either Western or Chinese tech stacks. Such neutral platforms must govern:

- EV charging interoperability

- Battery swapping standards

- Vehicle-to-grid communications

The Stakes

The average 18-year age of Africa’s vehicle fleet means today’s decisions will echo for decades. When the next 100 million African families enter the car market, will they drive:

- Chinese EVs running Beijing’s software?

- Tariff-priced Western models?

- Or African-designed vehicles on smart roads powered by local energy?

At 234Drive, we’ve watched this future take shape—in Shenzhen’s factories, Austin’s labs, and increasingly in Lagos’ workshops. The mobility revolution won’t wait for Africa to decide. But for those willing to build rather than beg, the road ahead is open.