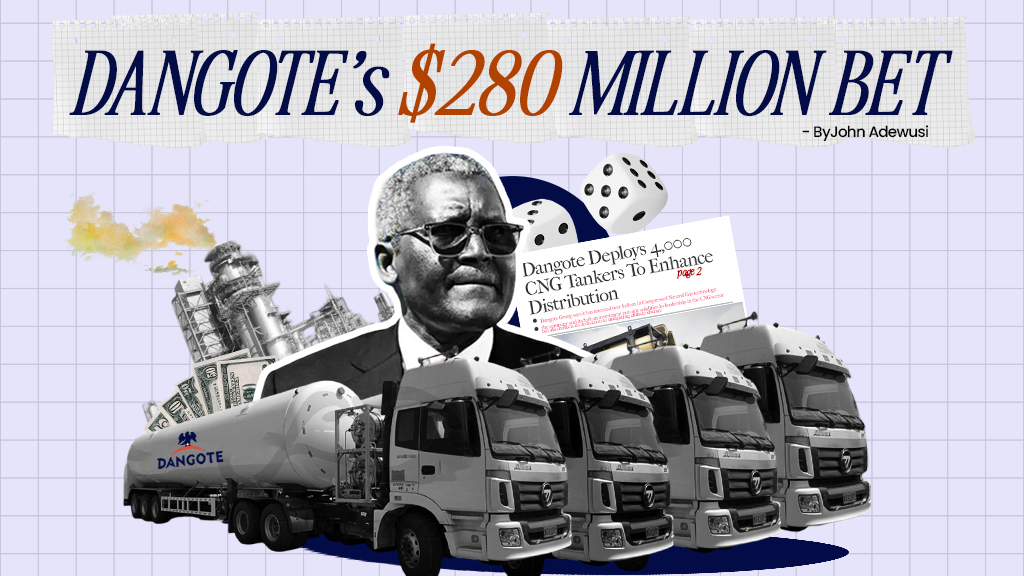

LAGOS, Nigeria — In a dusty yard on the edge of Lagos, hundreds of gleaming new trucks stand at attention. But these aren’t the belching diesel giants that have long ruled African highways. Instead, they’re part of a quiet but seismic shift: a $280 million bet by Aliko Dangote to turn Nigeria’s most wasted resource—natural gas—into the backbone of a new logistics future.

At a moment when Nigeria’s economy is suffocating under the weight of fuel subsidy removals, foreign exchange shortages, and fragile supply chains, Dangote’s move feels less like an incremental business pivot and more like a national intervention. His plan? Replace diesel trucks with a fleet of compressed natural gas (CNG) vehicles, cutting costs, emissions, and decades of economic absurdity in one stroke.

Fixing the Energy Paradox

Nigeria is a study in contradictions. It holds the world’s ninth-largest proven natural gas reserves yet flares off billions of dollars’ worth each year—a fiery testament to policy paralysis and underinvestment. Meanwhile, it spends $20 billion annually importing refined petroleum, including the diesel that fuels nearly every truck on the road.

Dangote’s CNG fleet is a bold attempt to flip this logic on its head. By investing ₦720 billion ($470 million), he plans to deploy thousands of CNG-powered trucks across his supply chains, from cement to sugar to petroleum. The projected savings? ₦1.7 trillion ($1.1 billion) annually in subsidy and import costs, alongside a 30% cut in emissions.

“This is about freeing Nigeria from its own contradictions,” Dangote has said. It’s a strategic move designed not merely to boost profits but to set a precedent for a country—and a continent—that desperately needs a new economic playbook.

The Hidden Backbone: Distribution as it Exists Today

Nigeria’s petroleum distribution system is an intricate dance. Once refined or imported, fuel travels from depots to over 5,000 filling stations across the country—mostly by road, using independent diesel-powered trucks. This web is supported by associations like the Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN), which represents marketers, coordinates supply arrangements, and helps manage the independent fleets crucial to keeping pumps flowing.

For decades, this decentralised, contractor-heavy system has been Nigeria’s lifeline, offering flexibility in a nation with unreliable infrastructure and volatile policy swings. PETROAN and the countless independent operators under it play a vital role, often bridging gaps left by weak public systems.

But this model is also expensive and fragile. Diesel price volatility, poor maintenance culture, and widespread inefficiencies make it a costly affair, driving up product prices and slowing down distribution cycles.

Dangote’s Vertical Play

Dangote’s pivot to a fully owned, CNG-powered fleet proposes an alternative future—one where distribution is streamlined, integrated, and self-reliant. Instead of relying on external truckers and contractors, Dangote will now control production (via his massive new refinery), storage, and transport, bringing unparalleled speed and efficiency.

This isn’t about displacing PETROAN or independent truckers overnight; rather, it introduces a parallel playbook. For the first time, a major Nigerian player is showing that it is possible to bypass traditional intermediaries at scale—a move that could inspire new strategies across industries.

The benefits to Dangote are clear:

- Cost stability: By using domestic gas, he reduces dependence on volatile diesel markets.

- Operational control: With a controlled fleet, he ensures punctuality and quality.

- Strategic leverage: As the country’s largest fleet operator, he shapes policy discussions and future logistics standards.

Beyond Fuel: Logistics as Economic Leverage

Nigeria’s logistics sector has long been its Achilles’ heel. Transport costs can account for up to 50% of product prices—a hidden tax that throttles businesses and fuels inflation. Aging trucks and frequent diesel shortages mean goods arrive late, expensive, or not at all.

The promise of CNG is twofold: lower operating costs (fuel savings of up to 60% compared to diesel) and improved reliability. Unlike traditional diesel engines, CNG trucks have simpler mechanisms and lower maintenance demands. For Nigeria’s estimated 42 million MSMEs, this could mean fewer supply chain disruptions and access to more competitive pricing.

Moreover, the ripple effects extend far beyond fuel. E-commerce players, from Jumia to informal last-mile riders, could finally achieve the scale they have long promised investors. Large FMCG groups like Tolaram (owners of Indomie and other staples) may also watch closely — and perhaps consider integrated logistics in other sectors.

Infrastructure: The Toughest Road Ahead

Transformation won’t come easily. Nigeria has fewer than 20 CNG filling stations—woefully inadequate for a country of over 220 million people. The upfront cost of a CNG truck, at ₦25–30 million ($16,000–$20,000), is prohibitive for smaller operators. Financing remains scarce, and diesel subsidies continue to distort the playing field.

Yet, momentum is building. The federal government’s National Gas Expansion Programme aims to convert 1 million vehicles to CNG by 2027, offering tax breaks and fleet incentives. International financiers are also eyeing projects that help Africa’s biggest economy decarbonise.

Echoes of History

A historical parallel lies in John D. Rockefeller’s 19th-century strategy to bypass costly, unreliable railroads by building Standard Oil’s own pipelines. That shift didn’t merely reduce costs; it also rewired an entire industry’s logic and consolidated Rockefeller’s power.

Unlike Rockefeller’s often ruthless displacement of intermediaries, Dangote’s approach doesn’t seek to erase Nigeria’s complex logistics ecosystem. Rather, it offers a new model, one that can coexist with—and challenge—existing structures to evolve.

Moving Africa Forward

Dangote’s strategy is as much about power as it is about fuel. His newly operational refinery— Africa’s largest—will supply the diesel that these very CNG trucks are designed to render obsolete. It’s a paradox worthy of the man himself: building a diesel empire while investing in its replacement. Yet in Nigeria, paradox is often the only path to progress.

At 234Drive, we believe mobility is more than movement; it is the engine of economic opportunity, social cohesion, and environmental resilience. Dangote’s CNG gamble represents a rare moment where a business decision could catalyse systemic change at scale.

If successful, those silent trucks rolling out from Lagos won’t just be delivering goods. They’ll be carrying the seeds of a new African logistics narrative: one that turns waste into wealth, inefficiency into empowerment, and dependency into autonomy.

Africa is watching. And so is the world.