Tesla’s charging empire just opened its doors to another competitor—and this time, it’s Subaru joining the convoy of automakers betting their electric future on shared infrastructure instead of isolated networks.

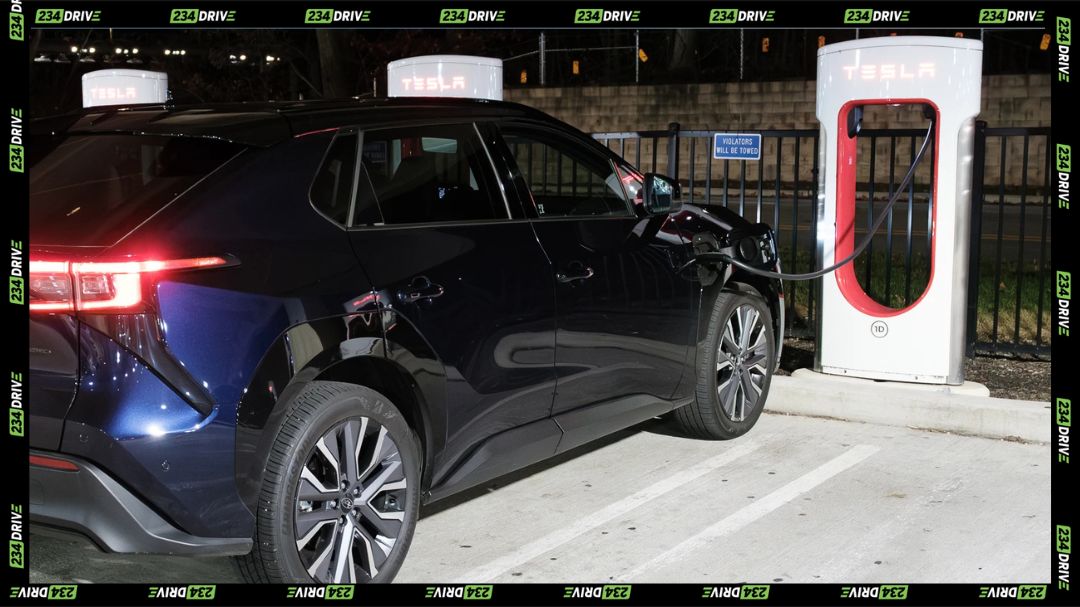

Subaru of America confirmed late October 2025 that all Solterra EV owners now have access to over 25,000 Tesla Superchargers across North America, marking the automaker’s full integration into the North American Charging Standard (NACS) ecosystem. The move splits neatly along model years: the 2026 Solterra ships with a native NACS port for plug-and-play compatibility, while 2023-2025 models require a purchasable adapter to bridge the gap from their original CCS ports. For buyers of the newest model, this means pulling into a Supercharger stall, plugging in, and watching the vehicle authenticate itself through SubaruConnect for automatic billing—no fumbling with apps or credit cards. Older Solterra owners face a different reality: they’ll need to buy Subaru’s Genuine Accessory Fast Charging Adapter at dealerships, with pricing still undisclosed. Unlike Ford, which handed out free NACS adapters to early EV buyers, Subaru’s charging customers for the privilege of backward compatibility.

The Solterra itself represents a joint venture between Subaru and Toyota, sharing bones with the bZ4X but carving its own path through Subaru’s signature all-wheel-drive DNA and outdoorsy branding. The 2026 refresh brings meaningful upgrades beyond the charging port swap: a 74.7-kWh battery delivers up to 288 miles of EPA-estimated range, a 25 percent jump over prior models, while the XT trim pushes output to 338 horsepower. DC fast charging capabilities now peak at 150 kW, though real-world performance on Tesla’s hardware tells a more measured story.

Field tests conducted on V3 Superchargers paint a picture of solid, if not spectacular, charging dynamics. Starting at 16 percent state of charge in 34-degree weather, a 2026 Solterra with preconditioning activated hit 121 kW at its peak around the 30 percent mark, sustaining 115-121 kW through the critical middle range before tapering to 104 kW at 61 percent and sliding to 91 kW by 72 percent. The full 16-to-85 percent session clocked in at 31 minutes, adding roughly 190 miles for $31.37—decent numbers hampered slightly by cold-weather efficiency losses. The takeaway: Subaru’s 400-volt architecture can’t match the blistering speeds of 800-volt platforms like Hyundai’s Ioniq 5, but it delivers predictable, anxiety-reducing performance for the road-tripper hauling kayaks to remote trailheads.

Subaru’s NACS adoption follows a script now familiar across the industry. Tesla cracked open its proprietary connector in 2022, inviting competitors to standardize around hardware it had already deployed at scale. Subaru announced its commitment in November 2023, targeting 2025 integration—right on schedule with Ford, GM, Volkswagen, BMW, and even Stellantis, the last major holdout to embrace NACS before pivoting toward a global rollout strategy. Nearly every volume automaker has either shipped NACS-equipped vehicles or committed to doing so by 2026, signaling the effective death of CCS as the dominant U.S. standard. What was once Tesla’s competitive moat has become the industry’s shared foundation, with over 25,000 Superchargers now functioning as de facto public infrastructure despite Tesla’s private ownership.

This shift addresses a longstanding Achilles’ heel for non-Tesla EVs: fragmented, unreliable charging networks. Early Solterra reviews dinged the model for underwhelming range and limited fast-charging access, criticisms that stung harder given the vehicle’s adventure-oriented marketing. By folding into Tesla’s ecosystem, Subaru instantly upgrades its value proposition—owners gain access to chargers that actually work, located where people actually drive, without the Russian roulette of broken CCS stations or payment system failures. The psychological lift matters as much as the kilowatt-hours: knowing you can reliably charge between Bozeman and Yellowstone transforms weekend trip planning from spreadsheet exercise to spontaneous decision.

The adapter situation for legacy owners introduces friction. Reports suggest quick handshakes—around ten seconds from plug-in to electrons flowing—and charging speeds that outpace some CCS networks like Electrify America. But adapter costs remain a black box, and Subaru’s decision to charge while Ford ate the expense sends a message about who bears the cost of infrastructure transitions. Port positioning adds another wrinkle: the Solterra’s charge port location may require careful maneuvering at crowded Supercharger sites where cable reach becomes tight, particularly with Tesla’s shorter V3 cables.

Globally, the NACS migration exposes regional fractures in EV standardization. While North America coalesces around Tesla’s plug, Europe remains committed to CCS2, and China runs its own GB/T standard with operators experimenting with megawatt charging for commercial fleets. Stellantis’s recent announcement to take NACS global suggests some automakers see value in manufacturing simplification even if it means managing regional plug variations, but the dream of true universal interoperability remains distant. The U.S. move feels less like visionary planning and more like pragmatic surrender to the reality that Tesla built the network everyone else failed to fund.

Ford and GM moved faster than Subaru on NACS integration, with Ford enabling Supercharger access in early 2024 through software updates and adapter programs months before shipping native NACS ports. GM followed a similar path, leveraging its Ultium platform’s flexibility to accelerate rollout. These first movers established proof of concept: cross-brand charging works, customers want it, and the operational headaches of managing multiple standards outweigh any competitive advantages from proprietary networks. Subaru’s entry, while later, benefits from watching others debug technical glitches and customer communication strategies.

The question now isn’t whether NACS wins in North America—that battle ended when the last major automaker capitulated—but whether this consolidation actually speeds EV adoption or simply transfers infrastructure dependency from one fragmented mess to a centralized chokepoint controlled by a single company. Tesla’s Supercharger network works because Tesla built it to work for Tesla’s cars with Tesla’s control over every variable. Opening that network tests whether the reliability survives when dozens of models with different charging curves, battery chemistries, and software quirks flood in. Early results suggest yes, but ask again when Supercharger stalls see five-deep queues of mixed-brand EVs during holiday weekends.