The 25th November 2025 announcement that Stellantis, through local distributor Urysia Limited, would introduce Jeep and Citroën to the Kenyan market represents a powerful endorsement of the country’s burgeoning status as a key economic hub. This strategic move sees Urysia evolve into a full multi-brand dealership, integrating Jeep’s rugged, adventure-ready 4x4s alongside Citroën’s focus on affordable, efficient urban models. The successful Jeep and Citroën launch event underscores the enthusiasm for new automotive options. The timing is critical, arriving amidst a wave of multinational investment and aggressive government efforts to transition the nation’s transport sector. This influx of brands signals strong investor confidence in Kenya’s stable policy environment and its growing middle class.

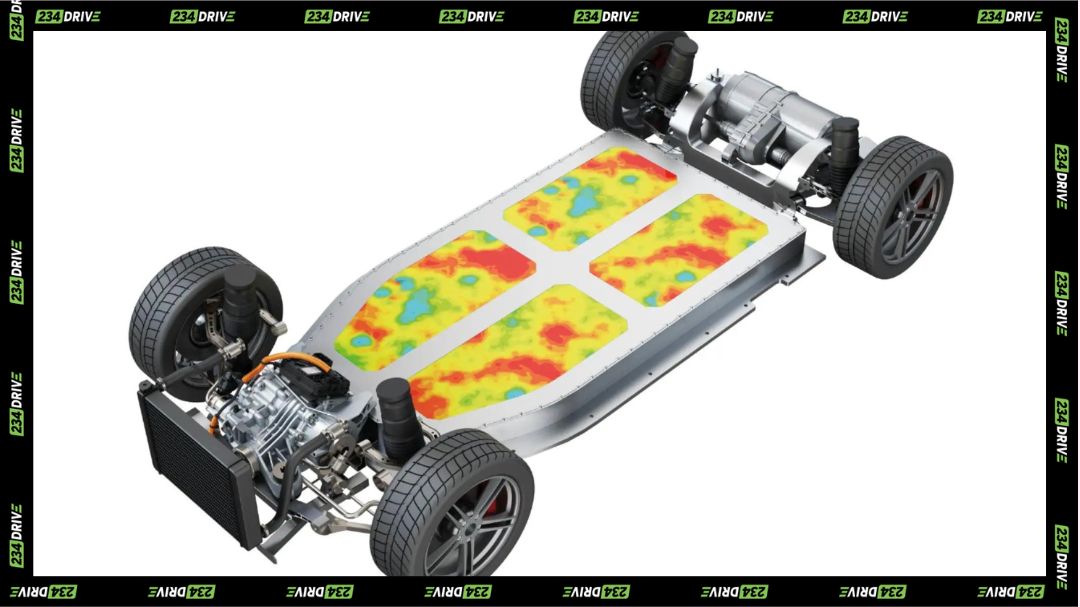

While the initial portfolio highlights popular internal combustion engine (ICE) models, including the rugged Jeep Grand Cherokee, Wrangler, and Gladiator, and the efficient Citroën C3, C3 Aircross, and C5 Aircross, the deeper strategic focus is on future electric mobility. Stellantis has been explicit about leveraging EV-ready platforms in emerging markets, paving the way for eventual local integration of globally available models like the Citroën e-C3. This aligns directly with Kenya’s ambitious agenda: the country is targeting 5% EV penetration in new vehicle registrations by the close of 2025 and is attracting significant international funds, including a recent Sh22 billion facility from Japan aimed at boosting local EV manufacturing capacity and reducing power costs for the sector.

The roles in this transformation are clearly defined. Urysia acts as the distribution arm, providing the essential sales and service network for these global marques. The government, however, is the primary driver of policy and infrastructure, creating a fertile ground for green investment through measures like zero-rated VAT and excise duty exemptions for electric vehicles and lithium-ion batteries. Meanwhile, international partners are providing the necessary capital and technology transfer, enabling local assemblers like BasiGo and Roam to build out the domestic value chain, thereby catering to both internal demand and export opportunities under the African Continental Free Trade Area (AfCFTA).

This expansion is more than a simple business decision; it signals a clear strategy to secure a first-mover advantage in a market where affordability and reliability are paramount. By offering Jeep for the premium, off-road segment and Citroën for the value-conscious urban commuter, Stellantis covers two essential market segments. The decision to enter now is strategic, capitalising on Kenya’s reputation as a reliable entry point to the EAC, a position strengthened by the government’s stable framework, which is designed to convert automotive sector growth into long-term profitability.

Kenya’s progress in e-mobility currently outpaces several regional peers, with the rapid uptake of electric two-wheelers dominating the statistics. Although still maturing, this ecosystem suggests the country is ready for the transition. The regulatory environment actively supports this: the 2023 Finance Act reduced excise duties on EVs, and the 2024 Building Code now mandates charging provisions in new commercial properties. The expansion of charging networks by national utility Kenya Power (planning 45 stations) and private firms like TotalEnergies further solidifies this framework, addressing the infrastructure gaps that have historically held back the rise of electric cars in Kenya.

The human capital dimension is equally vital to this story. The growth of the e-mobility value chain is projected to generate up to 100,000 jobs by 2030, creating high-value roles in assembly, maintenance, and charging infrastructure. While the initial entry of Jeep and Citroën may focus on sales and service, it contributes significantly to the broader sector’s momentum, which is already seeing local assembly plants employ hundreds of young workers and facilitate skills transfer. This sectoral growth provides considerable job and business opportunity hopes for the young demographic, cementing the automotive industry’s role in national development.

The integrated approach taken by the Kenyan government—from securing massive foreign financing to providing comprehensive incentives and an investment prospectus—demonstrates a concerted national commitment. As global automotive giants pivot to electrified platforms, this stable, incentive-rich environment makes Kenya an undeniable strategic choice. The true measure of this new multi-brand entry will be the speed with which Jeep and Citroën transition from their traditional ICE offerings to affordable, high-volume EVs, thereby helping Kenya meet its target of becoming Africa’s premier EV manufacturing and adoption centre.