The 2025 launch of the Haval H7 SUV by Great Wall Motor (GWM) in South Africa represents a highly strategic move designed to capture a significant share of the country’s burgeoning mid-size family SUV market. Positioned as a versatile, stylish, and robust vehicle, the H7 arrived in South Africa in January 2025, appealing directly to family buyers who demand value, modern technology, and, crucially, hybrid power. This introduction solidifies GWM’s commitment to the local market, offering a compelling alternative to established rivals precisely when the shift toward New Energy Vehicles (NEVs) is gaining tangible momentum locally.

The timing could not be better, given GWM’s and other Chinese manufacturers’ formidable performance in the first quarter of the year. While global Battery Electric Vehicle (BEV) sales surged by an impressive 42% year-on-year, driven largely by China, the local South African NEV market is being transformed by Hybrid Electric Vehicles (HEVs). Chinese brands have become market disruptors, capturing 11.81% of total South African vehicle sales in Q1. The Haval H7 is positioned perfectly to leverage this consumer appetite for electrification without the commitment to full BEV infrastructure, offering a blend of value and efficiency vital to the South African consumer.

The Haval H7 Deep Dive: Local Pricing and Rugged Styling

The Haval H7 distinguishes itself in the highly competitive mid-size SUV segment through a bold, uncompromising design. Often referenced overseas as the “Big Dog,” its aesthetic is rugged and muscular, featuring prominent wheel arches and a bluff profile that suggests a capability well-suited to diverse South African road conditions, from urban commuting to extended road trips.

The vehicle’s generous dimensions—approximately 4,705 mm in length and 1,780 mm in height—position it at the larger end of the five-seat segment, providing a commanding road presence. The key attraction for the local market is the H7’s aggressive value proposition: pricing ranges from approximately R601,950 for the entry model up to R730,950 for the hybrid flagship, ensuring it significantly undercuts many equivalently specified rivals. Standard features like alloy wheels, roof rails, and high-mounted LED lighting reinforce GWM’s reputation for offering high levels of equipment straight off the showroom floor.

Interior Comfort, Technology, and Hybrid Performance

Inside, the Haval H7 is meticulously crafted for the family buyer, emphasising space, comfort, and advanced technology. The cabin is spacious and well-appointed for five occupants, boasting desirable standard features such as leather-accented seating and a large panoramic sunroof on higher specifications.

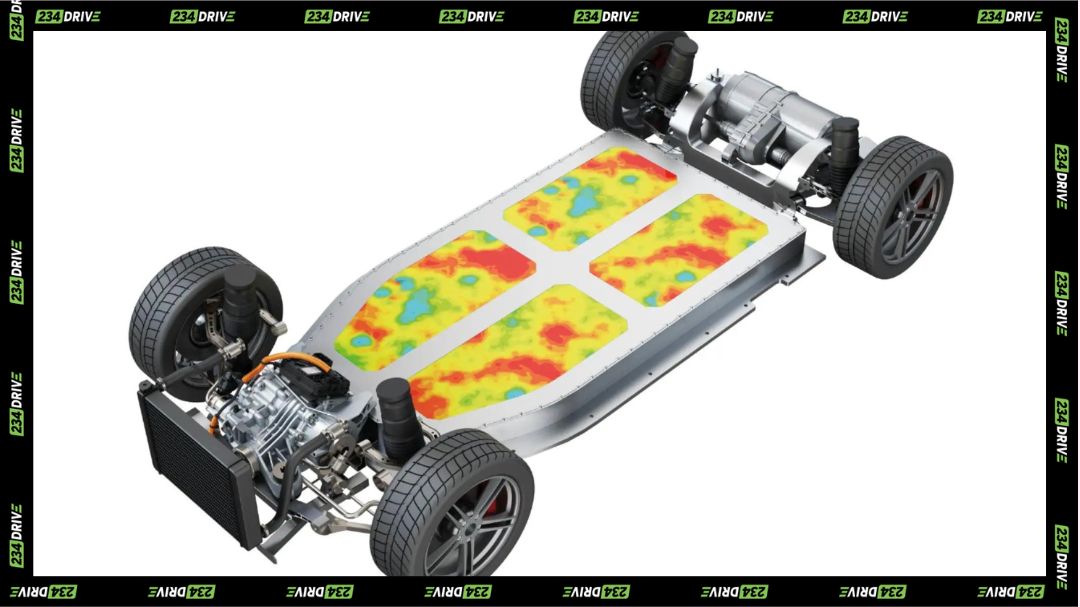

Central to the driving experience is the technology suite, which includes a dominant 14.6-inch infotainment screen. This unit manages connectivity, navigation, and climate control, alongside essential physical controls for immediate user interaction. Mechanically, the H7 offers a potent 2.0-litre turbo petrol engine delivering 170 kW and 380 Nm, paired with an 8-speed DCT. Crucially, for the fuel-cost conscious South African market, a highly efficient 1.5-litre turbo hybrid variant is available. This hybrid option boasts claimed system outputs of 179 kW and 530 Nm, providing significant performance while promising better fuel economy than its pure petrol counterpart. Drive options include standard front-wheel drive (FWD), with All-Wheel Drive (AWD) variants available for navigating challenging terrain. The robust pricing is clearly pitched to attract buyers looking for maximum specification for their Rand.

Local Market Context: NEV Growth in Q1 2025

While global EV sales saw a monumental surge, with BEVs alone climbing to a record 16% market share worldwide—a trend powered largely by China (which saw 55% BEV sales growth)—the South African market displayed a distinct, hybrid-led growth pattern in Q1 2025.

Total new vehicle sales reached notable volumes for the quarter, but the local market’s electrification story is currently driven by NEVs other than pure EVs. Despite the fact that SA’s EV sales dipped slightly, HEV sales jumped by 14.8% to 2,970 units, securing 85.2% of the total NEV volume. This makes the Haval H7 hybrid a highly relevant and practical vehicle that aligns with local consumer willingness to adopt electrified solutions that mitigate rising fuel costs without demanding a reliance on the country’s still-developing charging infrastructure.

Chinese Brands Consolidate South African Leadership

The strategic launch of the H7 is built upon the significant groundwork laid by GWM and its counterparts. Chinese brands have definitively shifted from niche players to core market drivers, capturing a robust 11.81% of all new vehicle sales in South Africa in Q1 2025.

GWM and Chery have led this charge, establishing themselves firmly within the top-selling brands locally. GWM’s strong performance, alongside Chery’s rapid expansion, collectively ensures that Chinese marques accounted for over 15,000 to 20,000 units sold during the first quarter. This powerful presence is not just about volume; it represents a significant change in consumer trust, with buyers increasingly willing to choose a Chinese brand over established rivals for their everyday motoring needs. This market dominance provides the ideal platform for the H7 to enter the fray as a flagship model.

How This Ride Fits South African Roads and Lifestyles

The Haval H7 is highly suited to the realities of South African motoring, where vehicles must withstand varied conditions and provide high utility over long distances. The demand for a “rugged” look is not merely aesthetic; it reflects the need for a durable family vehicle capable of handling urban pothole-ridden commutes and tackling demanding gravel tracks on holiday.

GWM counters any legacy concerns over long-term reliability and maintenance with a formidable seven-year, unlimited-kilometre warranty. This exceptional coverage significantly de-risks ownership for local buyers, providing peace of mind against high servicing costs and manufacturing defects. The H7’s hybrid efficiency is also a major factor, offering a welcome hedge against volatile local fuel prices. Its large size and high ground clearance (though primarily aesthetic, it offers practical benefit) further address the cultural and practical necessity for a tough, spacious family SUV capable of high-mileage ownership.

Comparison to Segment Rivals

The Haval H7 aggressively positions itself in the competitive R600,000 to R750,000 price bracket against stalwarts like the Toyota RAV4 and the Hyundai Tucson. The H7’s core strength is its feature-to-price ratio: buyers receive a higher specification level, more internal space, and an imposing aesthetic for less money than comparable hybrid or top-spec petrol variants from Japanese or Korean rivals.

However, the Chinese challenger must work harder to match the proven, market-wide reputation of its established competitors concerning long-term resale value and overall component durability. While the seven-year warranty offers crucial protection against premature failure, the RAV4 and Tucson benefit from decades of established trust in the local market, which translates into robust and predictable residual values. For many South African buyers, this financial stability remains a dominant decision factor.

In terms of driving dynamics, the H7’s combined 179 kW and 530 Nm hybrid system provides fierce performance and overtaking power. However, local reviews suggest that this performance is balanced by some compromise in refinement. Competitors often offer a more polished driving experience, with more accurate steering precision (like the Tucson) or superior real-world fuel consumption figures (like the RAV4 Hybrid). Furthermore, GWM needs to address minor local complaints, such as its driver assistance systems being critiqued for being overly intrusive and impacting the day-to-day driving experience.

Conclusion

The 2025 launch of the GWM Haval H7 is a clear watershed moment, cementing GWM’s status as a key player in the South African automotive industry. The H7’s competitive pricing, bold design, family-friendly size, and the availability of a hybrid powertrain make it a compelling choice that perfectly matches local market requirements for value and efficiency. Its strategic entry leverages the increasing dominance of Chinese brands and the strong growth of the NEV market in Q1 2025.

While the H7’s long-term reputation for reliability and resale value is still being built, its impressive specification and seven-year warranty offer an aggressive challenge to the established order. We are keen to hear your thoughts: given the H7’s price and features, would this new Chinese hybrid tempt you away from the traditional segment leaders in Mzansi? Let us know in the comments below.