For many Nigerians, owning a vehicle is a necessity rather than a luxury. However, the costs associated with car ownership, fuel, maintenance, and the mandatory insurance can quickly add up. Under the guidelines of the National Insurance Commission (NAICOM) and the Motor Vehicles (Third Party) Insurance Act, insurance is not just a suggestion; it is a legal requirement for every car on the road.

While the necessity of insurance is clear, the price tag often feels burdensome. If you are looking to protect your vehicle without breaking the bank, understanding the Nigerian insurance landscape is the first step toward significant savings. This guide explores practical, effective strategies to lower your premiums while maintaining the coverage you need.

Understanding the Nigerian Insurance Landscape

In Nigeria, car insurance is primarily divided into two categories:

- Third-Party Insurance: This is the statutory minimum required by law. It covers your legal liability for death, bodily injury, or property damage caused to a third party. While it is the most affordable option, it offers zero protection for your own vehicle in the event of an accident, theft, or fire.

- Comprehensive Insurance: As the name suggests, this provides a wider safety net. It covers everything included in third-party insurance plus damage to your own vehicle resulting from accidents, theft, fire, vandalism, and even natural disasters.

Annual premiums for comprehensive plans typically range between ₦25,000 and ₦150,000 for private vehicles, depending on various risk factors. Knowing the factors that affect these premiums is the key to manipulating them in your favour to ensure you aren’t overpaying.

Top Strategies to Reduce Your Premiums

1. The Power of Comparison

One of the most effective ways to save is also the simplest: shopping around. Rates can vary significantly between top-tier insurers like Leadway, AXA Mansard, AIICO, and Custodian. Each company has its own internal “risk appetite” and pricing model. By obtaining quotes from at least three to five different providers, you can identify which insurer views your specific profile most favourably. Researching the best insurance company for your specific needs is essential; never settle for the first quote you receive, as the market is highly competitive.

2. Choose the Right Level of Coverage

While comprehensive insurance offers peace of mind, it may not always be the most economical choice. If you drive an older vehicle or one with a low market value, the cost of a comprehensive premium over a few years might exceed the actual cash value of the car. In such cases, switching to a basic Third-Party policy can save you tens of thousands of Naira annually. Always weigh the costs of coverage against the potential payout to ensure your policy is appropriate for the asset’s current value.

3. Adjust Your Deductible (Excess)

An “excess” or deductible is the amount you agree to pay out-of-pocket before the insurance company covers the rest of a claim. Most insurers allow you to opt for a higher voluntary excess. By agreeing to take on more of the initial financial burden in the event of a claim, you signal to the insurer that you are a lower risk, which results in a lower annual premium. However, be cautious: only increase your excess to an amount you can comfortably afford to pay at a moment’s notice.

4. Leverage Security and Safety Features

Nigeria’s urban centres often face higher risks of theft and vandalism. Insurers are acutely aware of this risk. By installing security features such as GPS trackers, car alarms, or steering locks, you reduce the likelihood of a total loss for the insurance company. Many Nigerian providers offer discounts for trackers and other verifiable tracking systems. Not only does this lower your bill, but it also increases the chances of recovering your vehicle if it is stolen.

5. Build and Protect Your No-Claim Bonus (NCB)

One of the best rewards for safe driving is the No-Claim Bonus. For every year you drive without making a claim, insurers typically offer a discount on your renewal premium. Over several years, this can lead to substantial savings. To protect this bonus, consider paying for minor repairs out-of-pocket rather than filing a claim. If a small dent costs ₦15,000 to fix, but filing a claim would raise your next premium by ₦30,000 due to the loss of your NCB, it is mathematically wiser to handle the repair yourself.

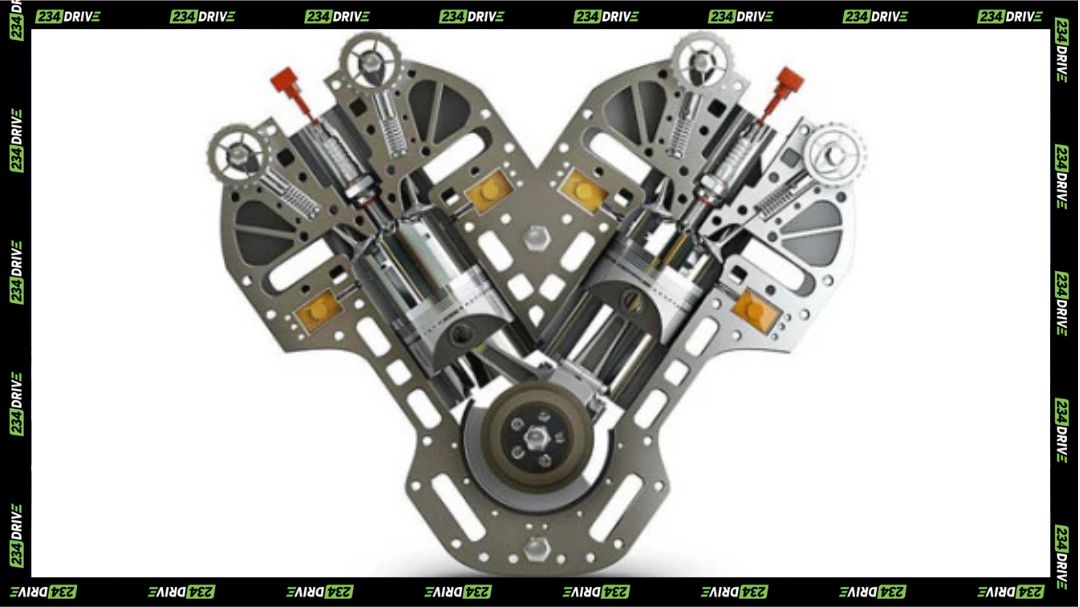

6. Consider Your Vehicle Choice

If you are currently in the market for a new car, remember that the make and model directly impact your insurance costs. Luxury cars or models known for being high-theft targets naturally command higher premiums. Furthermore, the electric revolution in Nigeria is slowly changing the landscape, as EVs may eventually offer different risk profiles compared to traditional internal combustion engines. Researching tips for reducing costs before purchase can save you a lifetime of high premiums.

7. Bundle Policies and Limit Mileage

Many insurance companies in Nigeria offer multi-policy discounts. If you already have life insurance or home insurance with a major provider, check if they offer a discount for “bundling” your car insurance. Additionally, some insurers are moving toward usage-based models. If you work from home or have a low annual mileage, mention this. Driving fewer kilometers reduces your risk of being involved in an accident, which can sometimes be leveraged for a better rate during your renewal negotiations.

Location and Regulatory Updates

It is important to note that where you live matters. If you reside in a high-traffic area in Lagos, your premium will likely be higher than if you lived in a quieter town. Furthermore, keep an eye on NAICOM updates. The government is increasingly focused on transport safety across all sectors; for example, the recent waterway safety measures regarding wooden boats reflect a broader push for stricter regulations. Staying informed about these shifts ensures you aren’t blindsided by changes in the motor insurance tariff.

A Proactive Approach to Savings

Lowering your car insurance premium in Nigeria is not about cutting corners on safety; it is about making informed, strategic decisions. By comparing quotes, maintaining a clean driving record, and opting for security enhancements, you can significantly reduce your annual expenditure.

Review your coverage annually. As your car ages or your driving habits change, your insurance needs will evolve. By taking a proactive approach and questioning your insurer about available discounts such as those for group policies or safe-driving certifications you can ensure you are getting the best possible value for your money. Remember, the cheapest policy isn’t always the best, but the most expensive one is rarely necessary. By implementing even two or three of these tips, you can navigate the Nigerian insurance market with confidence and keep more money in your pocket. Safe driving!