Like many people (at least in my generation), some of my fondest childhood memories come from sitting in front of the ‘tele’, learning how the world worked both directly and indirectly. Then, I asked questions whenever I didn’t understand what was happening, which was often, and when the answers grew shorter and more curt, I started forming my own assumptions.

One of those assumptions was that ‘people abroad’ had many cars. In movies, someone would fly to another state and still pick up a car to drive. It looked like they always had one waiting everywhere—like they owned a car in every state.

One day, while watching a scene in Due Date where Robert Downey Jr’s character walked out of the airport and immediately got into another car, I blurted out, “These people own a lot of cars.” My father gave me that amused look adults reserve for children and asked why I said so. My naive response was , “See now, he has so many cars.” Still smiling, he clarified, “They don’t own these cars. They rent them.”

I already knew what the renting concept meant, but up until then, the only things in my childlike mind that you could rent were apartments, chairs, canopies, Barney suits, and other party items. And when I asked if that was even “possible” in my home country, the response was a simple, dismissive “meh.”

Sixteen years later, that “meh” has turned into a nine-figure industry—one that is growing and becoming more prominent with every passing year.

Well, honestly, it didn’t take me 16 years to fully understand the idea or finances of renting a car. By the time I was about 13, a couple of firsthand experiences helped it click. When we had to hire a car to take my mum to Ibadan for a wedding, even then, hiring a car felt like a special arrangement—something you did for a faraway wedding or an airport pickup for an IJGB uncle who wanted air conditioning during a ride to Ekiti.

Luxury SUVs line up for a wedding day, showing how car rentals shape modern marriage celebrations. | Source: Lesus Executive Facebook

It wasn’t a decision you made within a day; it was planned and tied to a specific occasion. That’s quietly changing. Car hire is no longer just for big moments. People now rent cars for errands, events, business travel, everyday movement within the city, and interstate trips. What once felt like a deliberate choice is increasingly routine.

To better understand how this transition is playing out live, I reached out to some of the country’s leading car hire operators. The aim was to get a below-the-surface feel and a clearer picture of how Nigeria’s car hire culture has evolved—what’s working and what both customers and operators are still adjusting to.

What came from these conversations? In summary, demand is rising. Expectations are changing, and in some cases, Nigerians still haven’t fully adjusted to how car hiring works.

The Numbers Picture

To help you understand how the numbers work in this industry, here is a three-dimensional breakdown of how the numbers work in today’s car-hire market: the types of cars available, the revenue they bring in and the money behind running these fleets. When you look at it this way, the numbers start to explain why car hiring is slowly becoming a key part of the automobile sector and an everyday option.

The Cars

Spend a few minutes scrolling through Lagos car-hire listings, and a pattern shows up. Most fleets are built around a core mix of brands, with Toyota doing much of the heavy lifting. Models like the Fortuner, Highlander, and Land Cruiser show up repeatedly, largely because they suit local roads, long distances and offer various use cases.

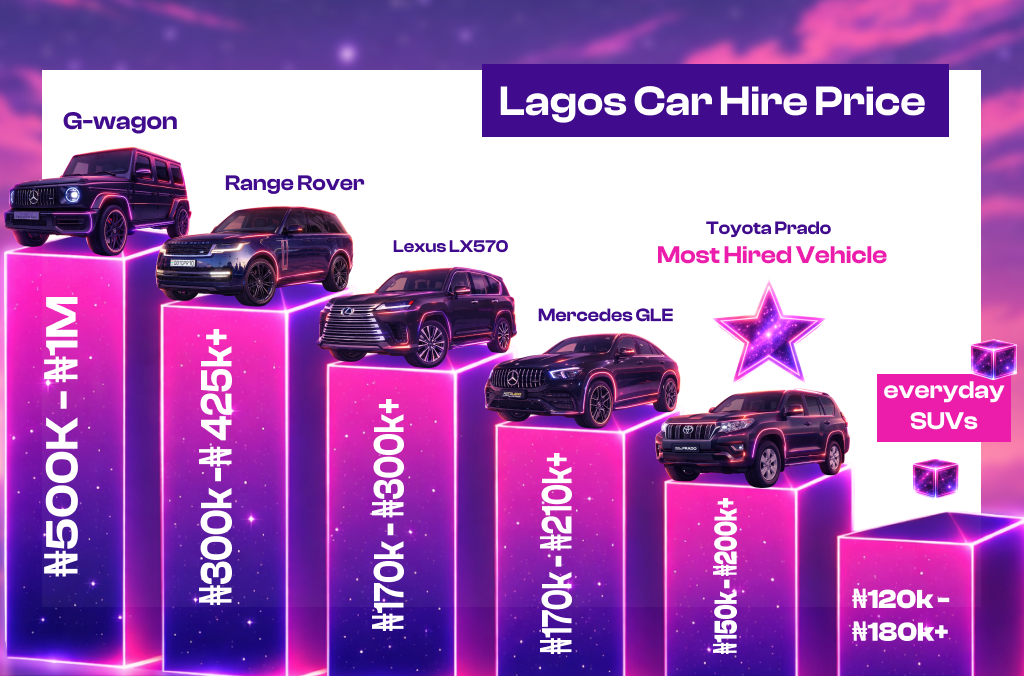

For those demanding cars slightly more upmarket, service providers pick up cars like the Lexus SUVs, particularly the GX 460 and LX 570. Daily rates here typically move between ₦170,000 and ₦300,000, rising further for newer or upgraded trims. Mercedes-Benz sits in a similar space: GLE models often fall around ₦170,000–₦210,000, while G-Wagons jump sharply into the ₦500,000–₦1 million+ range, depending on year and spec.

At the top end, Range Rover models—especially Vogue and Autobiography trims—are among the most expensive vehicles to hire, commonly ranging from ₦300,000 to ₦425,000+ per day. On the lower end, everyday SUVs from Hyundai, Honda, and Suzuki often start around ₦80,000–₦120,000 per day.

Not every provider publishes prices openly. One notable service provider detailed that public quotations often came with the illusion of fixed rates—harmful because clients would quote figures out of context, ignoring nuances like the distance or security needs of the trips.

Still, when providers talk about demand from clients, one model keeps coming up. The Toyota Prado has emerged as the most hired vehicle overall, with single-day rates typically sitting between ₦150,000 and ₦200,000, especially for newer or upgraded versions.

The Money-Spinning Industry

When following the money in any industry, private business owners rarely share exact revenue figures, so most insights come in hints rather than concrete numbers. One well-known car-hire operator was kind enough to share that monthly revenue can sit comfortably in the eight-figure range (above 10 million naira). Multiply that across a year and you’re already sitting in the nine-figure territory. So instead of taking it at face value, let’s press the numbers in and see how realistic it really is.

Let’s start with demand. Across interviews, the most requested vehicle was repeatedly the Toyota Prado. On average, most car-hire services hold at least three Prados in their fleet, largely because they’re almost always booked ahead. Again, daily rates typically fall between ₦150,000 and ₦200,000.

Upgraded Toyota Land Cruiser Prado 2020 VXR, 4.0L V6, premium interior, reinforced suspension. | Source: YouTube

Using a conservative daily rate of about ₦175,000 and assuming roughly 20 booked days in a month, a single Prado generates around ₦3.5 million monthly. Operating two Prados—factoring in slightly lower utilisation on one—pushes revenue to about ₦6 million. Add a third with lighter use, and Prado-only revenue can easily cross ₦7–8 million in a single month.

That’s just one model. Out of the rest of the fleet, that contributes significantly more. Now, a single high-end vehicle—such as a Range Rover or G-Wagon—can rent for ₦400,000 to ₦500,000 per day, meaning a simple two-day booking can generate close to ₦1 million on its own.

At the other end, operators rent smaller cars like the Corolla or Hyundai models for ₦80,000 to ₦120,000 per day, often booking them back-to-back for short trips and in-city use. When several run at the same time, the revenue builds quickly.

Taken together—across Prados, luxury SUVs, and everyday cars—eight-figure monthly revenue starts to look not just possible but realistic, more so during peak periods like December.

The Expense Side

Contrary to common belief, here are 3 corrections to popular misconceptions—yes, even I initially held similar assumptions:

1. Vehicles are forced out of the fleet after four or five years; they aren’t.

2. Proceeds from sold vehicles are used to fund the next purchase. That isn’t necessarily the case; new purchases are typically funded the same way businesses generate revenue.

3. Newer models are the main reason cars exit service. No, they aren’t.

Most cars remain in service for six years, or longer if they continue to perform well. These operators often extend a car’s working life through engine replacements or interior refreshes, and some of these updated vehicles end up outperforming newer additions. Cars are usually sold only when maintenance expenses start to outweigh returns.

Nevertheless, cars don’t pay for themselves overnight. Most operators expect to recover the cost of a vehicle within 18 months to three years, depending on how often it’s working. If a car is out on the road for about 15 to 20 days in a month, that timeline shortens. That’s why each vehicle is expected to carry its own weight—one car rarely covers for another, and how often it’s booked really matters.

Pricing isn’t guesswork either. Most operators start by checking what competitors are offering, then settle on a rate that works for them after factoring in fuel, driver wages, maintenance, and the risks that come with putting an asset on the road. Maintenance, in particular, creates constant cost pressure. Fake parts, uneven workmanship, and even theft force operators to actively monitor internal costs and tighten controls so nothing slips through the cracks.

Who’s Hiring Cars Now and What Shapes Trips

These days, the number of people hiring cars has grown a lot compared to a few years ago. Most demand still comes from individuals—people heading to events, coming into the country for a few days, or travelling between states without putting miles on their cars. For many of them, car hire has shifted from being one-off arrangements to more routine and practical.

Alongside everyday renters, car-hire providers say corporate clients still play a steady, though less visible, role. Companies often hire vehicles for project work, site visits, or staff movements, sometimes for weeks or even months at a time. These bookings occur less often, but they offer greater predictability, allowing providers to plan fleet use more confidently. Four out of five operators actively prefer this stability because it makes day-to-day operations easier to manage.

Location also shapes demand in obvious ways. Lagos remains the main starting point for most bookings, even when the final destination is somewhere else. Abuja follows closely, driven largely by business travel or government-related work and longer interstate trips. Beyond these two cities, requests frequently point towards states like Delta, Edo, Ondo, and Oyo—routes commonly linked to family events, regional business, and regular interstate movement.

Security of the Asset—Both Individual and Car

Security is also a big part of these conversations as well. In the past, escorts were sometimes arranged informally and were fairly common for certain trips. These days, tighter enforcement and changing regulations have shifted that approach. A major driver is the recent federal directive under President Bola Ahmed Tinubu restricting the use of police officers for private and VIP escort duties.

Hired cars were once commonly escorted by police or security personnel, showing how safety shaped premium travel at the time. | Source: Daily Post NG

As a result, when security is required, many operators now rely on licensed private security providers. Some car-hire services have entered into standing arrangements with these firms so they can continue to meet client expectations, while others choose not to offer escort services at all. Either way, that single policy changed how these service providers handle security. What used to take a quick message or two to arrange a VIP escort, according to a source, is now a more formal and costly process and far less flexible. Security has shifted from a simple add-on to something that must be carefully considered for every trip. Today, it influences not just the route and the price but also the type of car assigned—whether it’s discreet, more robust, or suited for longer distances—and, in some cases, whether the booking is worth taking on at all.

Expectations, Realities and What Makes Good Business.

As Nigeria’s car-hire market continues to grow, the expansion has not been without friction. Increased demand has brought scale and visibility, but it has also highlighted the everyday misunderstandings that come with a service becoming more mainstream.

Most issues still start with time and availability. Customers often assume a booking covers a full 24 hours and that dispatch can happen instantly. In practice, most hires run on 12-hour windows, scheduled dispatch times, and driver rotations. Even when operators provide accommodation, drivers remain human and can’t be activated on demand. Four out of five car-hire providers report repeated cases of driver mistreatment. When both sides fail to align on timing and availability early, tension often builds before the journey even starts.

As volumes increase, certain patterns repeat. Late returns remain the most common pressure point for most providers. Even with grace periods, some customers overrun their time and push back against extra charges. Missed calls, delayed payments, and last-minute disputes don’t just affect one booking—they disrupt schedules set aside for other clients. In more extreme cases, one provider admitted that the driver had to be recalled to base before a client eventually acknowledged breaching the initial agreed terms.

Social media has given dissatisfied customers a quick and visible outlet, allowing complaints to escalate fast, sometimes without full context. Car-hire providers that manage this best tend to lean on clear rules, written agreements, and consistent processes rather than making one-off decisions and statements.

Shorter bookings are another area where expectations and reality often clash. While three- or six-hour hires may sound convenient, the economics rarely work. Fuel, driver costs, logistics, and vehicle wear don’t reduce neatly with time, which is why most providers structure their services around longer booking windows.

Vehicle expectations can create similar gaps. Customers often want near-new luxury SUVs at prices that suit older models. In a market with high buying and upkeep costs, premium vehicles naturally cost more. The gap usually comes down to whether both sides are seeing the price and value in the same way.

When I asked a car-hire operator what a fair experience really looks like, the answer was simple: set expectations early and respect them on both sides. Clear timing and transparent pricing for a vehicle that genuinely fits the budget and route.

They noted that the most memorable bookings are often uneventful—ironically so. In most cases, the car arrives as agreed, communication stays clear, the trip runs without delays, and the vehicle returns on time. Some clients even send small gifts or leave generous tips to show appreciation for a smooth, stress-free experience.

As ride-hailing fees continue to rise, coupled with frequent cancellations and the discomfort that can come with inconsistent rides, it is worth watching if car hire finds a gap and becomes more normal than we expect. For some users, the value is already shifting from convenience alone to predictability, comfort, and control.