General Motors is currently navigating a high-stakes mechanical crisis that threatens to stall the momentum of its most profitable internal combustion flagships at a time when the industry is transitioning toward electrification. This structural failure in the core of its petrol-engine fleet represents one of the most significant quality-control challenges for the company in recent years, putting both its balance sheet and its reputation for reliability under intense scrutiny.

In a significant blow to its engineering standing, the Detroit-based automotive giant issued a massive recall in April 2025 covering approximately 597,630 vehicles in the United States and 721,000 globally. This action, identified under NHTSA campaign number 25V-274, specifically targets heavy-duty luxury SUVs and pickups equipped with the 6.2L V8 L87 petrol engine. The financial and logistical scale of the operation is vast, with estimates suggesting that federal investigations could eventually expand the scope to over one million units as reports of catastrophic engine failures continue to mount from owners across North America.

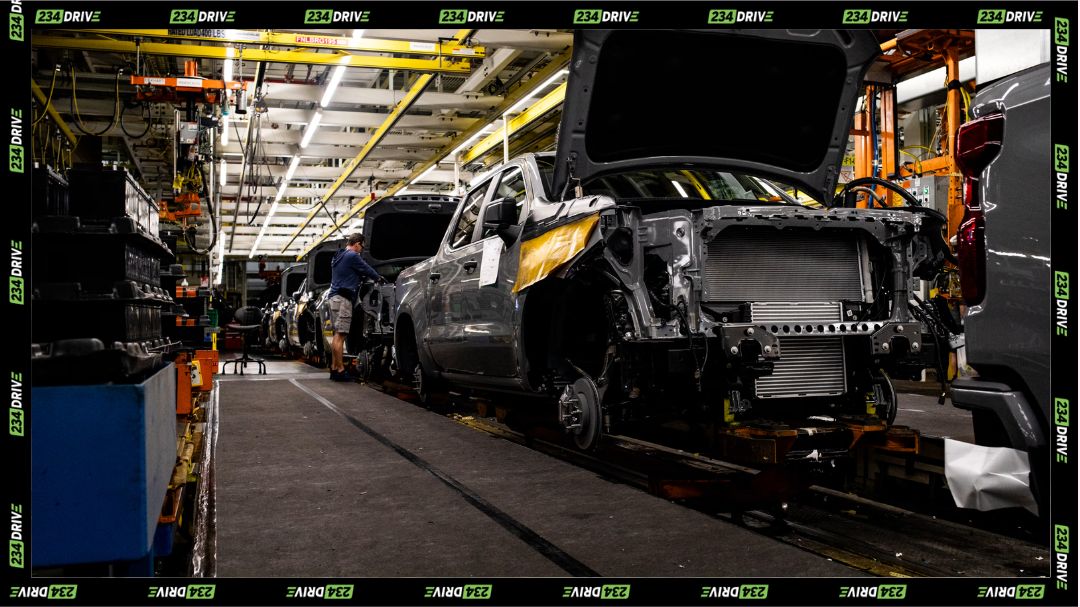

The heart of the controversy lies in the L87 power plant, a high-performance engine designed to provide the necessary grunt for premium models like the Cadillac Escalade, Chevrolet Silverado, and GMC Yukon. While the engine was built to deliver class-leading towing capacity and acceleration, manufacturing defects in the connecting rods and crankshafts have turned these powerhouses into significant liabilities. This design flaw reportedly leads to premature bearing failure, which can cause the engine to seize entirely a risk detailed in recent recall reports or, in extreme cases, result in a connecting rod puncturing the engine block at motorway speeds.

The situation involves a complex interplay of industry actors where clear divisions of responsibility have emerged. General Motors manages the massive logistical rollout of the recall and handles customer relations, while external suppliers are being scrutinised for the initial quality control failures in the internal engine components. Simultaneously, the NHTSA acts as the primary regulatory watchdog, recently escalating its probe to an Engineering Analysis as failures outside the initial recall scope continue to be reported.

This crisis marks a challenging pivot for General Motors, which has had to shift its focus from aggressive electrification to intensive quality-control remediation for its traditional V8 fleet. To secure the long-term viability of these models, the company implemented production changes in mid-2024 to rectify the component flaws at the source. However, the strategic need to maintain the loyalty of truck and SUV owners who represent the company’s highest-margin customers means that the success of this recall is critical to funding the broader transition to electric vehicles.

While the issue is most concentrated in North America where these large-capacity engines are most popular, the global reach of the recall highlights a disparity in how different regions handle mechanical defects. Compared to European markets, where smaller-displacement engines and stricter emissions standards are the norm, the US market’s heavy reliance on these large-block V8s makes the fallout from such a defect significantly more impactful on national transport safety and corporate balance sheets.

Industry analysts are drawing sharp comparisons to how rival manufacturers have handled similar mechanical crises in recent years. While some competitors have moved swiftly from identification to full engine replacements across their entire affected fleets, the decision by General Motors to prioritise a viscosity-based fix switching to thicker 0W-40 oil has been met with considerable scepticism. Critics argue that while this might mitigate the immediate symptoms of bearing wear, it does not address the fundamental structural weaknesses as effectively as the more comprehensive replacements seen in other high-profile industry recalls.

The current predicament for the manufacturer is informed by its history of navigating large-scale safety issues and technical investigations. The company’s internal investigation, which involved the analysis of over 28,000 failed engines, proves it has the technical capability to diagnose deep-seated manufacturing flaws. However, with over 1,000 complaints and a history of consolidated lawsuits now gathering pace in Michigan federal courts, the company is under immense pressure to prove that its current strategy is more than just a temporary solution to a permanent mechanical problem.

As the legal battle progresses into 2026 and the NHTSA considers expanding the recall to include even more model years, the ultimate cost to the company may go far beyond the price of oil changes and engine blocks. It raises a fundamental question for the industry at large: as manufacturers rush to perfect next-generation electric platforms, are they inadvertently allowing the quality standards of the traditional engines that still fund their existence to slip through the cracks? Should regulators treat these systemic engine failures as a reason to accelerate the transition away from internal combustion entirely?