The Gigmile brand anchors a mobility platform built to expand access to income-generating vehicles. | Source: Instagram

Access to a reliable vehicle can change a person’s entire economic path, and one Nigerian mobility startup is quietly rebuilding that reality at scale.

Gigmile, a Nigerian mobility financing company, has raised a new seed round to power its next stage of expansion, strengthening its push in a market where millions still struggle to access income-generating vehicles.

Who Are the Minds Behind Gigmile, and What Inspired the Company’s Beginning?

Kayode Adeyinka, co-founder and CEO (left), and Samuel Esiri, co-founder (right)| Source: Gigmile

Founded in 2022 by former Jumia executives Kayode Adeyinka and Samuel Esiri, Gigmile focuses on financing solutions for gig workers who struggle to obtain vehicles through traditional banks. In many parts of Africa, lenders still require collateral, long credit histories, or formal documentation that most informal workers simply do not have. Gigmile was built to close that gap.

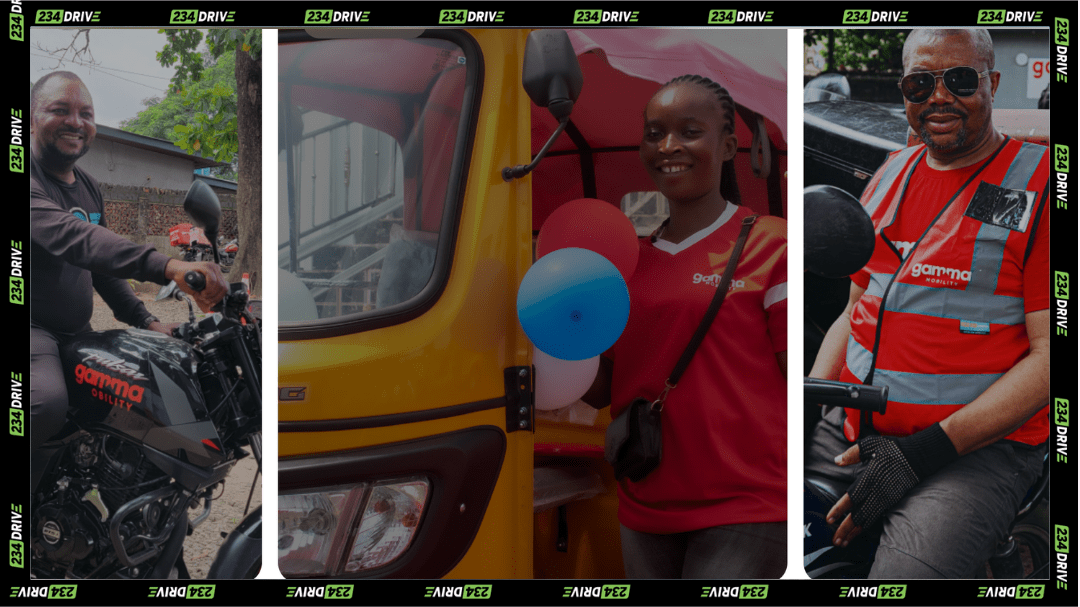

Its flagship platform, Gamma Mobility, uses a lease-to-own model that allows riders to finance, manage, and eventually own motorcycles, tricycles, cars, and personal commuting vehicles. To date, the company has deployed more than 10,000 vehicles, supports 8,500 active riders, and reports that 1,500 individuals now fully own their vehicles. This mobility ecosystem currently spans 13 cities across Nigeria and Ghana, supported by partnerships with vehicle suppliers, financiers, and major mobility platforms.

Gamma Mobility users with their financed vehicles: a motorcycle rider on the left, a tricycle recipient in the centre, and another rider seated on a motorcycle on the right. | Source: Gigmile

With the newly secured seed round—led by Enza Capital with participation from Seedstars International Ventures and Norrsken Africa Fund—Gigmile is entering a more aggressive growth phase. The company has now raised a combined US$21 million in debt and equity and plans to expand into more than 15 new cities within the next year. It is also targeting US$100 million in financed mobility assets by 2027, with Series A conversations expected in early 2026.

Alongside the funding, the company has released its 2025 Impact Report, outlining results across financial, social, and sustainability metrics. The report highlights progress in income stability for riders, increased access to asset ownership, and alignment with the UN Sustainable Development Goals. It also details plans to onboard more women and advance a clean mobility roadmap.

CEO Kayode Adeyinka noted that the findings reinforce the scalability of a technology-driven, capital-efficient model designed for emerging markets. According to him, structured mobility financing can grow profitably while delivering measurable economic mobility for underserved populations.

As Gigmile moves into its next chapter, it continues to pursue its goals as a mobility startup focused on helping people earn stable incomes and achieve financial independence through accessible vehicle financing.