Tesla’s arrival in Morocco marks the definitive end of the “wait-and-see” era for high-performance electric mobility on the African continent.

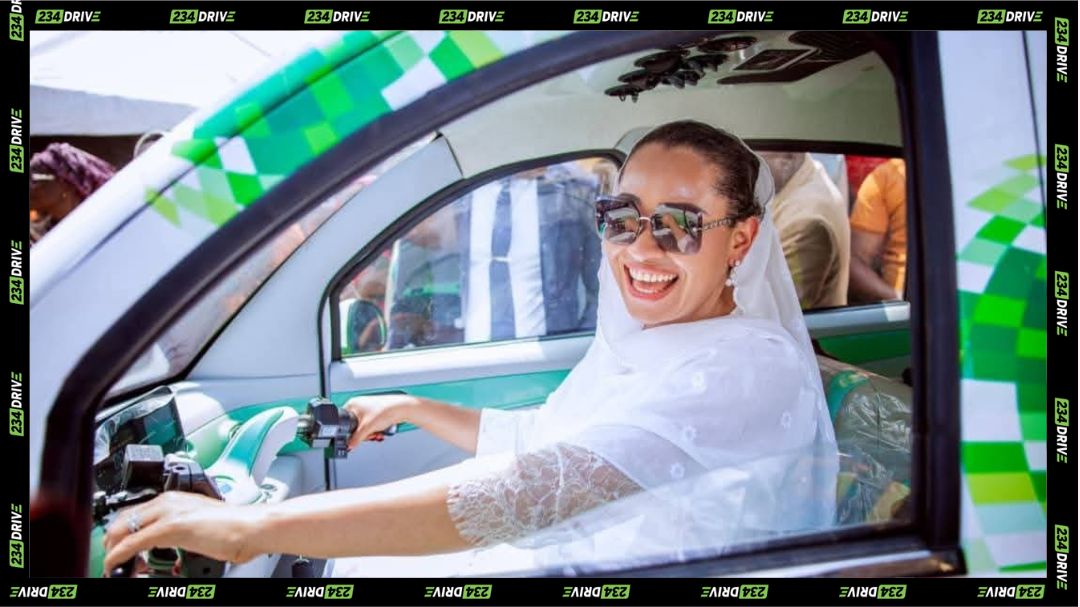

Tesla has officially inaugurated its African operations with a landmark launch event in Casablanca, following the initial news of Tesla’s launch in Morocco in late January. On 6 February 2026, the American manufacturer established its first retail presence at the AnfaPlace Shopping Mall, opening a pop-up store that serves as the command centre for its entry into the Moroccan market. This move includes the immediate activation of an online configurator, allowing Moroccan customers to order the refreshed Model 3 and Model Y directly in local currency, with the first fleet of official deliveries slated for the third quarter of 2026.

The launch was not merely a retail opening but a high-impact technology showcase, themed around the momentous arrival. It featured the Cybertruck and the Optimus humanoid robot alongside the consumer-facing models. By displaying these flagship projects, Tesla is positioning itself in Morocco not just as a car vendor, but as a comprehensive robotics and energy firm. The Model Y, particularly the premium all-wheel-drive variants, is being positioned competitively at approximately 549,990 MAD, aiming to disrupt the luxury internal combustion engine market which has long dominated the region’s automotive landscape.

The operational backbone of this expansion is a pre-existing and rapidly growing infrastructure network that Tesla has been quietly cultivating for years. Unlike many market entries that promise future support, Tesla has arrived with roughly 24 stations listed in the local superchargers directory already operational. These hubs include Casablanca, Agadir, Marrakech, Rabat, Tangier, and Fes. While these stations are currently smaller than their European or North American counterparts—typically housing between four and nine stalls—they are strategically located to facilitate seamless intercity travel along Morocco’s primary highway corridors.

This strategic pivot towards Morocco is a calculated play leveraging the kingdom’s robust automotive supply chain and its aggressive renewable energy targets. Morocco currently hosts massive manufacturing operations for global giants like Renault and Stellantis, and its goal of reaching 50% renewable energy generation by 2030 provides the “green” credibility Tesla requires for its ecosystem. Furthermore, the kingdom’s favourable tax environment, which sees customs duties on electric vehicles reduced to as little as 2.5%, provides a fiscal advantage that Tesla is using to undercut traditional premium European marques that are still hampered by fossil-fuel-based import tariffs.

In comparison to other emerging markets, Tesla’s Moroccan execution has been notably infrastructure-led. In mature markets, the Supercharger network often lags behind vehicle sales, but here, the company has ensured that the charging experience is ready before the first official customer takes delivery. This “charging-first” model mimics the company’s early successful expansions in Europe and North America, aiming to eliminate range anxiety from day one as the brand opens its first African location.

The speed of this deployment is particularly impressive, moving from the registration of a local subsidiary in 2025 to a full-scale public launch in early 2026. By establishing a direct-to-consumer model, Tesla is bypassing the traditional dealership structures that often slow down EV adoption in Africa due to a lack of technical expertise or incentive to move away from ICE service revenues. This allows Tesla to maintain strict control over the brand experience and service quality as it tests the waters for a broader continental rollout.

Morocco now serves as the primary gateway for Tesla’s ambitions across North Africa and potentially the wider Mediterranean basin. The success of this launch will likely serve as the blueprint for future entries into markets such as Egypt or South Africa, where infrastructure challenges remain the primary barrier to entry. This deployment effectively shifts the conversation from whether Africa is ready for electric vehicles to how quickly the existing energy infrastructure can scale to meet the inevitable demand.

This milestone marks the transition from niche, gray-market imports to a mainstream, fleet-scale operation that could redefine the region’s transport sector. As Tesla begins to integrate its energy storage solutions and charging tech into Morocco’s solar-heavy grid, the primary question for regional planners is no longer about the viability of the technology, but whether national regulations are prepared to treat EV charging networks as essential public infrastructure to further accelerate adoption.