The UK automotive sector finally broke the two-million barrier in 2025, but the celebration is muted by a stark realisation: the recovery is being driven not by the old guard, but by a wave of affordable technology from the East that has left established players scrambling to compete.

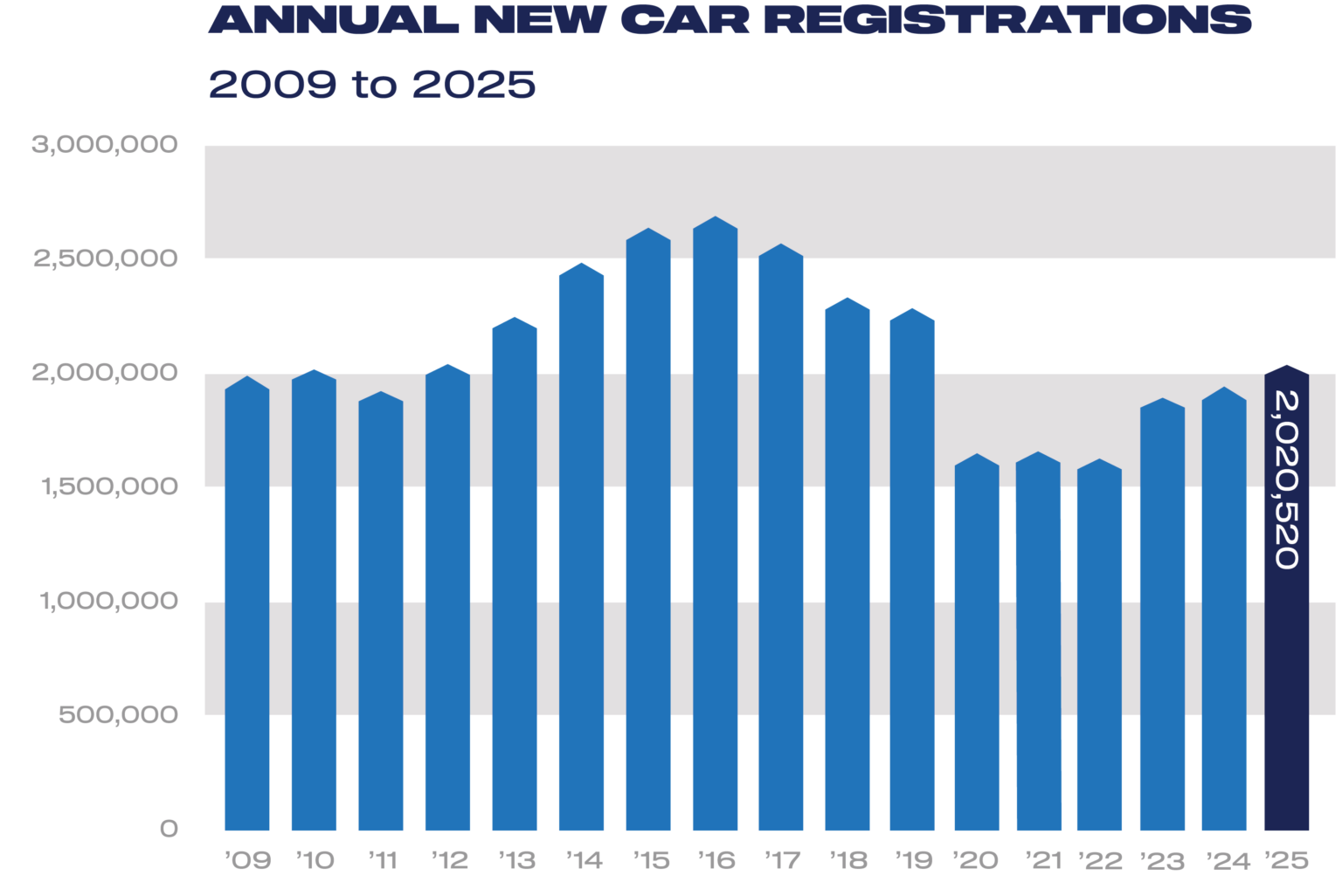

In a year defined by heavy discounting and regulatory pressure, the market recorded 2,020,520 new car registrations, a 3.5% increase on the previous year and the first time volumes have surpassed the two-million threshold since 2019. While this signals a return to growth for the UK economy’s manufacturing engine, the underlying numbers reveal a turbulent transition. Private buyer demand remains tepid compared to pre-pandemic levels, with growth largely propped up by fleet purchasing and massive manufacturer subsidies designed to force electric vehicles (EVs) onto driveways. The SMMT’s official data portal confirms that while volumes are up, they still lag significantly behind the 2.3 million peak of the last decade, suggesting that the “new normal” is a smaller, more fractured marketplace.

The headline success story of 2025 was the record-breaking performance of battery electric vehicles (BEVs), which achieved 473,348 registrations—a 23.9% year-on-year jump. BEVs now command a 23.4% market share, and when combined with hybrids, nearly half of all new cars sold in the UK are now electrified. However, this growth came at a steep cost. To chase the government’s ambitious Zero Emission Vehicle (ZEV) Mandate, which demanded a 28% sales mix for EVs, manufacturers unleashed a torrent of incentives averaging £11,000 per vehicle. Despite these efforts, the industry missed the statutory target, leading trade bodies to warn that such discounts are unsustainable without consistent long-term government support or a revision of the mandate’s aggressive timeline.

The most disruptive force in 2025 was undoubtedly the explosive rise of Chinese automakers. Brands like BYD, Omoda, and Jaecoo have effectively stormed the market, collectively capturing nearly 10% of all UK sales. This Chinese brands boom is not just a volume story but a strategic victory; by offering high-tech, feature-rich EVs at price points legacy manufacturers cannot match, they have democratised electric mobility for a price-sensitive public. BYD alone saw its registrations surge by 485% to over 51,000 units, a performance that has fundamentally altered the competitive landscape and forced European rivals to rethink their pricing strategies.

This shift has claimed a high-profile casualty: Tesla. Once the undisputed king of the UK’s electric market, the American giant saw its dominance erode significantly, with total registrations falling nearly 10% to 45,513 units. The decline accelerated as the year closed, with a Tesla UK car sales slump of over 27% in December alone. Analysts point to an ageing model lineup and the aggressive pricing of rivals as key factors. Globally and locally, the narrative has flipped; China’s BYD outsells Tesla in key segments, marking the end of Tesla’s era of unchallenged supremacy in the EV space.

Despite the disruption, some familiar names held their ground at the top of the leaderboard. Volkswagen reclaimed the number one spot with robust growth, while the Ford Puma retained its title as the country’s best-selling model. However, a deeper look at the winners and losers exposes the pain felt by brands in transition. Jaguar’s sales effectively evaporated as it ceased production of its internal combustion models ahead of a pure-electric relaunch, and Fiat struggled to find traction. Conversely, newer entrants like Cupra and Polestar continued to thrive, proving that heritage is no guarantee of survival in a software-defined era.

As the industry looks toward 2026, the question is no longer when EVs will take over, but who will supply them. The UK new car market overview suggests that while consumer appetite for electric driving is growing, it is highly price-elastic. With the 2030 ban on new petrol and diesel cars looming, the battle lines are drawn: legacy brands must urgently lower costs or risk ceding the mass market to agile newcomers who view the UK not just as a sales destination, but as a beachhead for European expansion.