The UK motor industry has witnessed a tectonic shift at the start of 2026, as the once-dominant Tesla saw its registration figures crater while affordable Chinese competitors and established legacy brands like Ford seized control of the battery-electric vehicle (BEV) market. This dramatic realignment signals a new era of “hyper-competition” where brand loyalty is being tested by aggressive pricing, diversified powertrain options, and a rapidly expanding choice of models for British consumers.

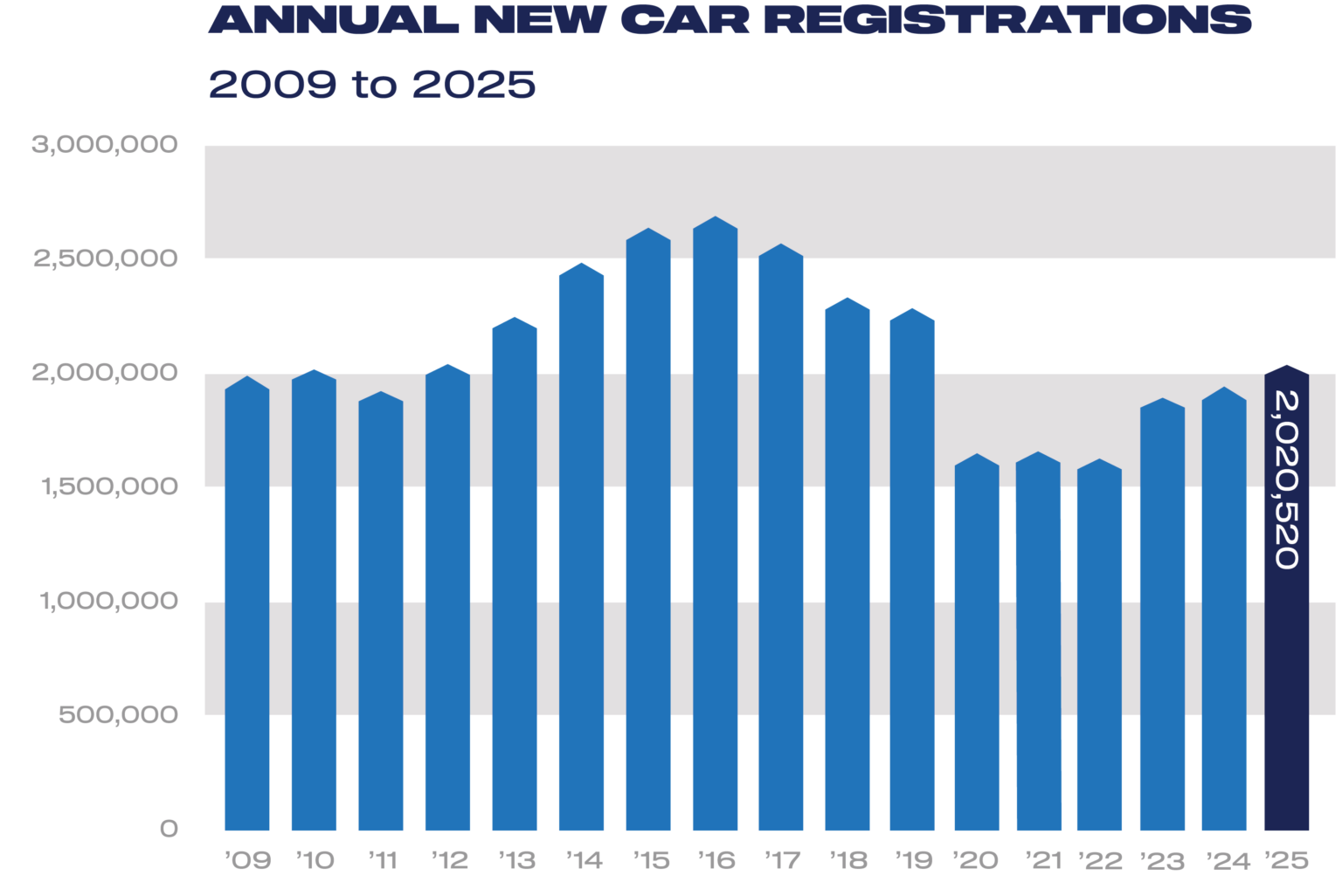

The core of the month’s narrative lies with the Society of Motor Manufacturers and Traders (SMMT) and New Automotive reporting a total of 144,127 new car registrations for January 2026, a 3.4% increase over the previous year. While this represents the strongest January performance since the pre-pandemic era of 2020, the headline figures mask a worrying stagnation in the pure electric sector. BEV registrations grew by a marginal 0.1% to 29,654 units, causing their total market share to dip to 20.6% from 21.3% a year earlier. This cooling off is largely attributed to a “hangover” effect from the UK car market 2025, when manufacturers pushed heavily to meet regulatory targets, and a pull-forward of sales to avoid the new Vehicle Excise Duty (VED) rates set to take effect this April.

The most startling development is the precipitous fall of Tesla, which recorded just 647 to 718 registrations—a staggering year-over-year decline of between 50% and 57%. This collapse in volume saw the American pioneer tumble to 20th in the BEV brand rankings, a position almost unthinkable eighteen months ago. Industry analysts suggest Tesla is struggling with a maturing product lineup that lacks a truly “budget” entry, alongside intense pricing pressure from rivals. While the upcoming “Juniper” update for the Model Y is expected to bolster figures later in the year, the January data highlights a vulnerability in Tesla’s UK strategy as it faces a more crowded and price-sensitive marketplace.

In stark contrast, Ford has emerged as the surprise leader of the electric revolution, more than doubling its prior-year performance to secure over 2,271 BEV registrations. Ford’s success has been underpinned by the Puma Gen-E and the Explorer, capturing an impressive 8% share of the electric market. This resurgence was significantly aided by the reintroduction of government incentives; the £3,750 Electric Car Grant was utilised by over 1,200 Puma Gen-E buyers in January alone, representing a £4.7 million investment by the government to stimulate private demand. This move highlights how targeted policy interventions remain a critical lever for traditional brands trying to transition their existing customer bases to electric power.

The roles within this shifting market are becoming more clearly defined: while Ford and Volkswagen (the latter also surpassing 2,000 units) are leveraging their massive dealer networks and fleet relationships, Chinese manufacturers are winning on technology-to-price ratios. BYD has firmly established itself as a major player, with its BEV sales rising 21% to over 1,300 units. More impressively, when including its plug-in hybrid (PHEV) models like the Seal U—which ranked sixth overall in the total car market—BYD’s total registrations reached 4,021 units. This “dual-track” strategy of offering both full electric and hybrid options is proving highly effective at capturing buyers who are still hesitant to go fully “sparky.”

This business shift signals that the UK market is no longer just about early adopters; it is now a battleground for value. The rapid ascent of Jaecoo, a newcomer that has been in the country for barely a year, further illustrates this point. The Jaecoo 7 model recorded 4,059 registrations, placing it second in the overall market. By offering feature-rich SUVs at price points that undercut European and American rivals, Chinese brands like Jaecoo, BYD, and MG are securing their supply chains and expanding their UK footprints with remarkable speed, moving from initial launch to major market share in record time.

Comparisons with the broader European market show that the UK’s BEV slowdown is somewhat an outlier, as continental EV sales rose by 37.3% in the same period. This suggests that the UK’s specific regulatory environment and the impending tax changes are creating unique friction amidst shrinking battery demand. However, despite the January dip, the SMMT has actually upgraded its full-year forecast for 2026, predicting that BEV share will eventually climb to 28.5%. While this remains short of the government’s 33% Zero Emission Vehicle (ZEV) mandate, it reflects an optimism that a wave of new, more affordable models arriving throughout the year will re-energise private buyers.

The track record of the last three years proves that the UK market is highly volatile and reactive to both price and policy. The current situation suggests a shift from the “hype” phase of electric vehicles to a “fleet-scale” operational phase, where consistency of supply and cost-of-ownership are the primary drivers. For Tesla, the challenge is to refresh its brand image and product range to stay relevant. For the Chinese “invaders,” the goal is to build long-term trust and infrastructure, often supported by projects like the Sunderland battery gigafactory which helps secure the local supply chain. For legacy brands like Ford, the mission is to maintain the momentum gained through recent grants.

Ultimately, the data from January 2026 poses a significant question for both the industry and the government: should electric vehicle technology be treated as a luxury consumer good or as essential public infrastructure? If the UK is to meet its ambitious 33% mandate by year-end, further policy adjustments or more aggressive manufacturer incentives may be required to prevent the current dip from becoming a long-term trend. The coming months will reveal whether Tesla’s slump was a temporary blip or the beginning of a permanent shift in the hierarchy of the British automotive world.