Tesla’s announcement on October 7, 2025, introduced new ‘Standard’ versions of its Model 3 sedan and Model Y SUV, aimed at offering more affordable entry points into the EV lineup. The Model 3 Standard starts at $36,990 (~₦ 54.7 million), while the Model Y Standard starts at $39,990 (~₦ 59.1 million), excluding destination fees. The company hopes these models will attract budget-conscious buyers following the expiration of the U.S. $7,500 EV tax credit on September 30, 2025.

However, the launch has drawn mixed reactions across social platforms, with critics arguing that the pricing still doesn’t qualify as truly affordable EVs. Tesla unveiled the Standard variants just a week after the U.S. federal EV tax credit expired, aiming to maintain buyer momentum despite higher effective prices. Deliveries are expected between November and December 2025, and orders are already live on Tesla’s website. The decision to release de-contented trims—models with fewer features but retaining essential Tesla tech—comes as part of Tesla’s strategy to maintain production efficiency and control costs amid global EV competition, particularly from Chinese manufacturers like BYD offering sub-$20,000 EVs.

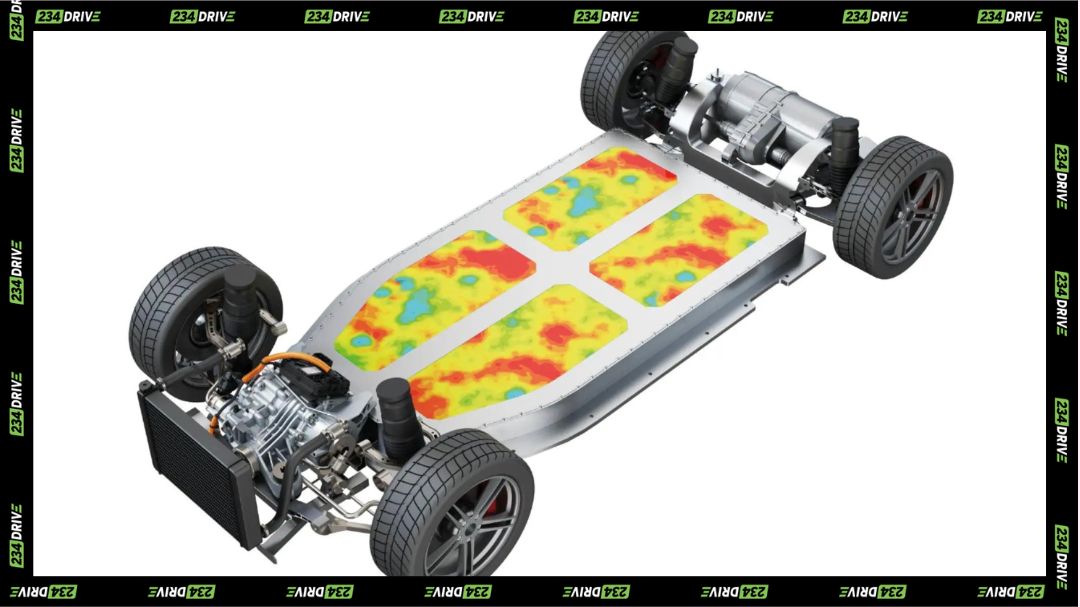

These entry-level versions maintain Tesla’s signature efficiency and tech but sacrifice certain luxuries to lower costs. The Model 3 Standard costs $36,990 (₦ 54.7 million) with a range of 321 miles and a 0–60 mph time of 5.8 seconds. It includes FSD hardware, a 15.4-inch touchscreen, and OTA updates, but omits premium audio, ventilated seats, and a glass roof. The Model Y Standard is priced at $39,990 (₦ 59.1 million), offering similar range and practicality, though it lacks third-row seating and premium ride quality. Including destination and order fees (~$1,640), the total prices rise to around $38,630 (~₦ 57 million) for the Model 3 and $41,630 (~₦ 61.5 million) for the Model Y. Tesla claims a 34% range improvement over its 2019 equivalents despite inflation, attributing this to battery efficiency and lighter builds.

Both models include Tesla’s latest Full Self-Driving (FSD) hardware (HW4), featuring eight cameras and a vision-only system compatible with FSD Supervised software. While the hardware is pre-installed, full functionality requires a $99/month subscription. This inclusion signals Tesla’s continued push toward autonomy, even in budget models. The FSD v14 software upgrade launched alongside the cars, improving complex driving scenarios such as roundabouts and parking decisions.

The launch aligns with Tesla’s goal to boost sales volume after a 5% year-over-year delivery decline in Q3 2025. Analysts see this as a short-term move to sustain demand amid shrinking margins. The U.S. BEV market share in September 2025 stood at around 10–11.8%, with Tesla holding roughly 53% of those sales. Analysts expect a 20–30% BEV decline in Q4 following the end of the tax credit. Globally, BEV adoption continues to rise, with Europe reaching 20.2% and the UK 22.1% by late September 2025.

Reactions on X (formerly Twitter) have been divided. Many criticised the pricing, noting that even with reductions, these models remain above the $30,000 affordability threshold. Some praised the inclusion of FSD hardware, viewing it as a long-term value play. Others highlighted Tesla’s challenge against BYD and other Chinese brands offering EVs for under $20,000 (~₦ 29.5 million). Investor sentiment reflected this skepticism, with TSLA shares falling 4.5% after the announcement as analysts called the pricing underwhelming.

Tesla’s new Standard models mark a pivot from margin-heavy sales to volume-focused growth. Analysts estimate gross margins could drop to 15–18%, though higher sales might offset this. Key developments to watch include the Cybercab and Juniper Model Y updates in 2026, possible U.S. policy revisions reinstating some EV incentives, and increased competition from global brands offering cheaper EVs. Despite criticism, Tesla remains well positioned to benefit from efficiency improvements and software-driven revenue streams such as FSD subscriptions. The company continues leveraging OTA updates to enhance post-purchase value, giving it an edge competitors still struggle to match.

The October 2025 launch highlights Tesla’s balancing act between affordability and technology. While not the sub-$30,000 EV many anticipated, it keeps Tesla accessible to mid-tier buyers seeking autonomy-ready vehicles with reliable performance. This move signals Tesla’s next growth phase—optimising existing platforms instead of reinventing them. As global EV competition intensifies, affordability may prove the true deciding factor in determining the leader of the next decade of electric mobility.