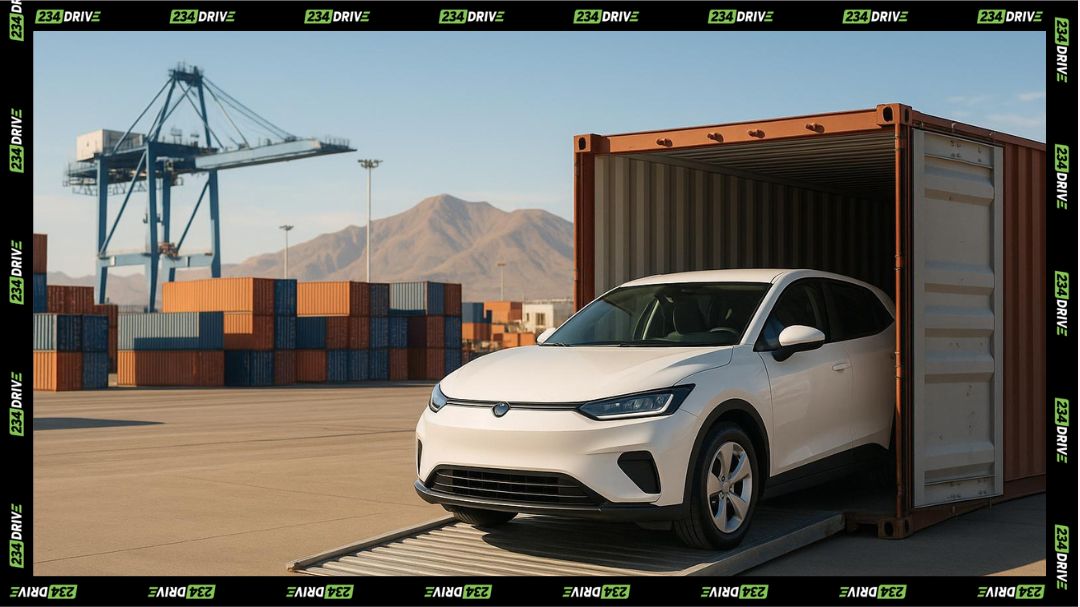

Morocco is rapidly positioning itself as an essential manufacturing powerhouse for electric vehicles (EVs), driven by soaring exports to the European Union (EU) and growing ambitions across Africa. This robust growth, evident towards the end of 2025, is primarily orchestrated by aggressive governmental policies and the strategic utilisation of existing preferential trade agreements, notably the EU-Morocco Association Agreement. This agreement grants duty-free or low-duty access for vehicles and components meeting strict rules of origin, consolidating the nation’s strategic pivot towards EV and SUV production. The automotive industry already reached $14 billion in exports in 2023, a figure the electric push is set to dramatically increase, with the ultimate goal of achieving one million vehicles in annual production capacity.

The most significant update in December 2025 is the government’s confirmation of integrating the entire battery-to-EV value chain, from raw materials to final assembly, designed to feed both the European market and regional partners. Major players such as Gotion High-Tech, COBCO, Renault, and the brand-new Tesla subsidiary attest to this dynamism. Morocco is actively scaling up its EV capacity, with a projected leap of 53% to reach approximately 107,000 units by year-end, and this acceleration is set to continue into 2026 with the commissioning of several gigafactories and component plants.

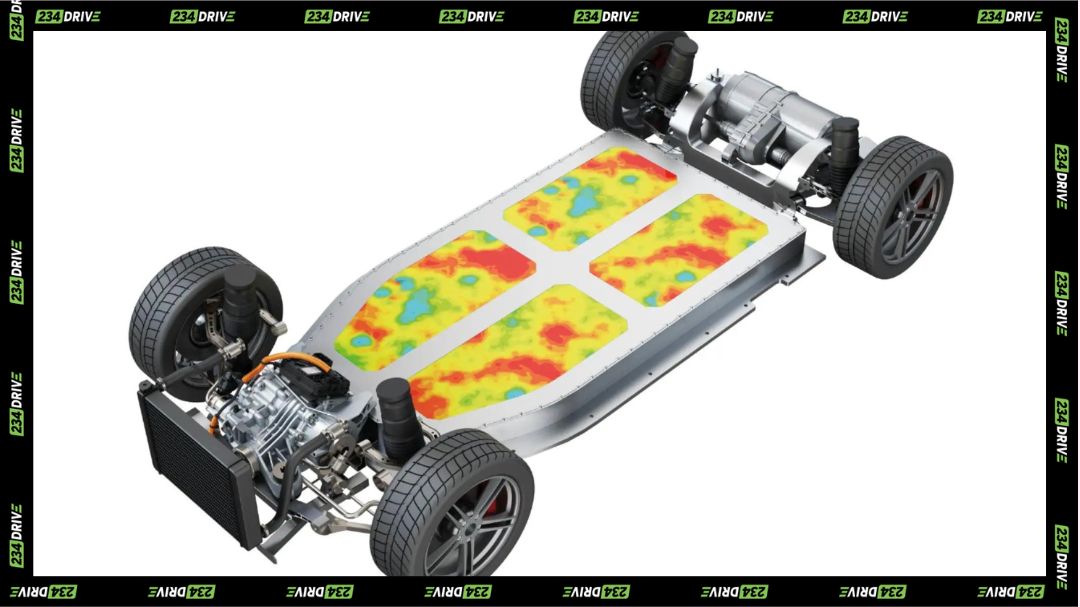

What is currently being built and launched in the coastal zones of Tangier and Kenitra is nothing less than a complete ecosystem. The focus is on leveraging the vast national phosphate reserves, a key asset enabling the local and sustainable production of lithium iron phosphate (LFP) batteries. This ‘green manufacturing’ strategy is underpinned by strong government incentives: VAT exemptions, reduced customs duties, and corporate purchase bonuses of up to MAD 100,000. Furthermore, projects benefit from competitive, renewable energy, as the country aims for 80% green power by 2050. Morocco is already producing mini-EVs for Europe (Citroën Ami, Fiat Topolino) and is preparing for the launch of the fully Moroccan vehicle, the Dial-E by Neo Motors, in January 2026.

In this new configuration, the roles are clearly defined. Major international firms, such as Gotion High-Tech, COBCO (precursor production), and Renault (EV lines), are constructing the state-of-the-art production infrastructure. The Moroccan government facilitates investment, secures supply chains for raw materials (phosphate, cobalt, manganese), and deploys fiscal incentives. Assembly plants located near ports, such as Kenitra, are preparing to become export hubs. Tesla’s 2025 investment for a potential capacity of 400,000 units per year illustrates the platform’s attraction as a springboard to the EU.

This strategic move signals a profound transformation in the Moroccan economy: it is about securing its position as the EU’s privileged supplier for the electric age. By integrating the entire LFP battery value chain, Morocco is no longer content merely to assemble; it is localising and decarbonising production, a major competitive advantage against tightening European environmental regulations. Moreover, the ambition is to utilise surplus battery production capacity to serve African ‘regional partners.’ This positions Morocco not only as North Africa’s EV hub but also as a viable logistical and economic alternative to Asian supply chains for the continent, aligning with opportunities presented by the AfCFTA (African Continental Free Trade Area).

When comparing this pace to other regions, Morocco demonstrates impressive execution speed. Where many African nations, and even some in Eastern Europe, are still at the stage of announcing and planning gigafactories, Morocco already has battery precursors being exported since January 2025, with full cell production scaling up rapidly into 2026. However, it is important to note that the Moroccan industry remains firmly focused on phosphate-based LFP technology, capitalising on local resources. There is, to date, no evidence of the integration of advanced technologies such as niobium nanotechnology in EV components in Morocco, an area where advancements are still primarily global.

Morocco relies on a strong track record in the conventional automotive industry, with Renault and Stellantis plants already well-established in the Tangier Med free zone, proving its capability to manage complex supply chains and produce high volumes to European standards. These prior milestones lend essential credibility to the new EV projects. The upcoming launch of Renault’s new EV lines and the commencement of Dial-E production by Neo Motors prove that the transition is concrete and that local expertise is being leveraged.

This wave of investment and development clearly marks the shift from a mere labour supplier to a globally strategic industrial platform. Morocco is not just meeting demand; it is actively shaping the supply chains of the future by offering a low-carbon, logistically advantageous, and politically stable solution. However, one question remains open for policymakers: Will the domestic charging infrastructure and adoption policies keep pace with this export-driven growth, ensuring that Moroccan citizens fully benefit from the electric revolution their country is leading?