The strategic entry of China’s automotive behemoth, Dongfeng Motor Corporation, into Kenya’s electric vehicle (EV) sector marks a pivotal moment, signalling an acceleration of East Africa’s green mobility transition. This move, secured through a partnership with local firm ePureMotion, is a sharp one-liner in the narrative of African industrialisation, promising lower prices for consumers and cementing Kenya’s status as a regional manufacturing centre. The collaboration focuses not merely on vehicle importation but on deep local value creation, with assembly scheduled to begin in 2026 at Associated Vehicle Assemblers (AVA) in Mombasa, a commitment that aims to leverage significant tax incentives and boost local job creation.

The core announcement centres on the introduction of the ePureCitie, a compact hatchback designed specifically for urban driving. This initial rollout features two variants: the Classic, priced affordably at approximately KSh 4 million (about $30,000 USD), offering a respectable 330 km range; and the Lux variant, priced at KSh 4.5 million, which extends the range to 430 km and includes advanced features such as Level 2 ADAS (Advanced Driver Assistance Systems) for enhanced safety. These models are strategically positioned to appeal to urban commuters, corporate fleets, and ride-hailing services in traffic-congested cities like Nairobi, immediately broadening the accessibility of electric transport.

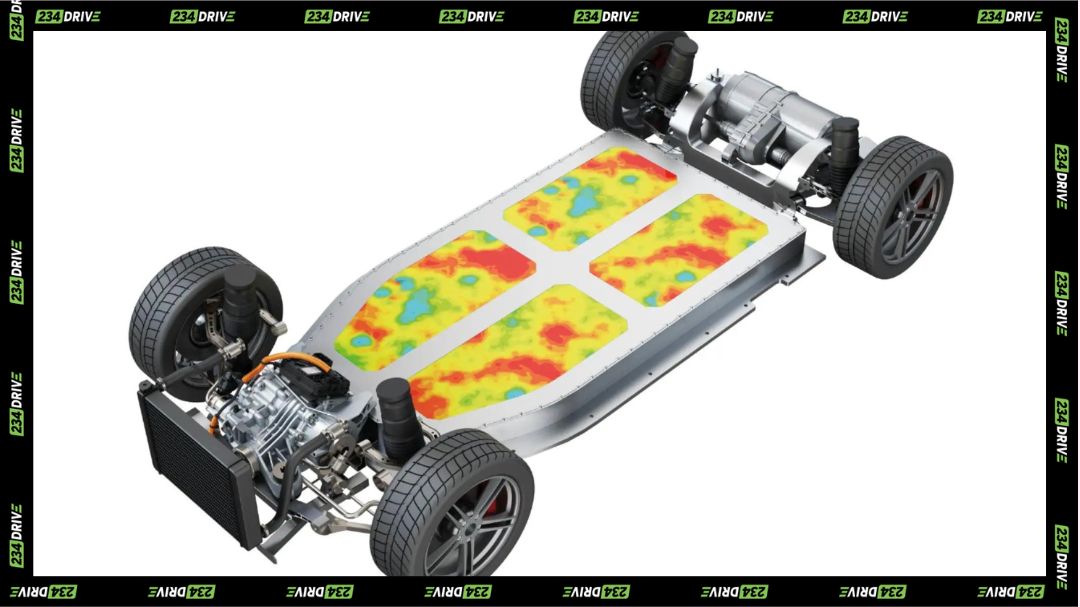

The long-term success of the programme hinges on a clearly defined division of labour. Dongfeng provides the technological expertise, global supply chains, and vehicle platforms (localised versions of its Nammi sub-brand), while ePureMotion furnishes invaluable market insights, distribution networks, and a rapidly expanding charging infrastructure. Crucially, ePureMotion has already inaugurated the ePureXperience Centre in Nairobi, a fully integrated facility that merges sales, smart charging, and after-sales support into a single hub. Local partner AVA provides the critical assembly capacity required to meet the demands of the government’s National Automotive Policy.

This alliance signals a significant business shift away from fully built imports towards local Completely Knocked Down (CKD) assembly, a strategy that directly supports Kenya’s policy objectives. By assembling domestically, the partnership qualifies for crucial financial relief, including a waiver on the 35% import duty levied on complete built units and a reduced 10% excise duty for locally assembled EVs. These incentives are projected to lower the final retail price by up to 25-30%, a measure essential for democratising EV ownership. Furthermore, the plan includes introducing light commercial EVs in early 2026, targeting the logistics and public transport segments and demonstrating a commitment to comprehensive market coverage.

The competitive landscape in Kenya reveals a clear price war brewing, with the ePureCitie models offering a distinct advantage. While other high-profile EVs, such as the BYD Atto 3, command prices around KSh 12 million, and the BYD Dolphin sits at KSh 7.5 million, Dongfeng’s aggressive pricing from KSh 4 million positions it as a disruptive force. This strategy echoes the wider trend of Chinese automakers accelerating the EV transition across Africa, often using CKD kits and local partnerships to bypass high import tariffs and establish early market dominance—a pace that contrasts sharply with the traditionally slower market entry typical of European or Japanese legacy manufacturers.

Kenya’s EV ecosystem is maturing rapidly, with registrations surpassing 6,442 units by mid-2025. This strong adoption rate, driven by favourable government policies, illustrates the speed of local execution. ePureMotion’s establishment of a state-of-the-art integrated experience centre, combined with the planned assembly programme at AVA, shows a commitment to building a full lifecycle service model, which includes charging, maintenance, and skills transfer, rather than simply moving product. This proactive infrastructure development is key to sustaining the market momentum generated by the affordability of the new vehicles.

Dongfeng’s credibility is built on its track record, having recently held a Global Partnership Summit, as one of China’s ‘Big Four’ state-owned automotive groups, boasting a global annual production of over three million vehicles. The corporation’s existing commercial presence in Kenya, via DFAC Kenya Ltd., provides a strong, reliable foundation for this ambitious passenger EV expansion. This established operational base reduces market risk and provides immediate logistics and distribution familiarity.

Ultimately, while the partnership between Dongfeng and ePureMotion provides the technological impetus and affordability necessary to catalyse mass adoption, the long-term success of the venture and the green mobility programme as a whole remains dependent on external factors. Ongoing developments in expanding the charging network—crucial for supporting the new vehicles—and maintaining policy stability from the Kenyan government will be key. This aggressive entry signals the true shift from niche imports to fleet-scale, affordable EV operations, but the durability of the green transition hinges on whether regulators treat charging infrastructure as the public utility it is poised to become.