The global automotive landscape shifted violently on 6 February 2026, as Stellantis announced a staggering €22.2 billion ($26.5 billion) writedown, signaling a massive retreat from its once-aggressive electric vehicle ambitions. This monumental financial hit represents the largest impairment in the history of the car industry, dwarfing the previous records set by Ford and General Motors only months prior. By wiping out a sum larger than its own market capitalisation in a single stroke, the parent company of Jeep, Ram, and Vauxhall has effectively hit the “reset” button on its transition to a zero-emission future, prioritising immediate profitability and consumer demand over regulatory ideals.

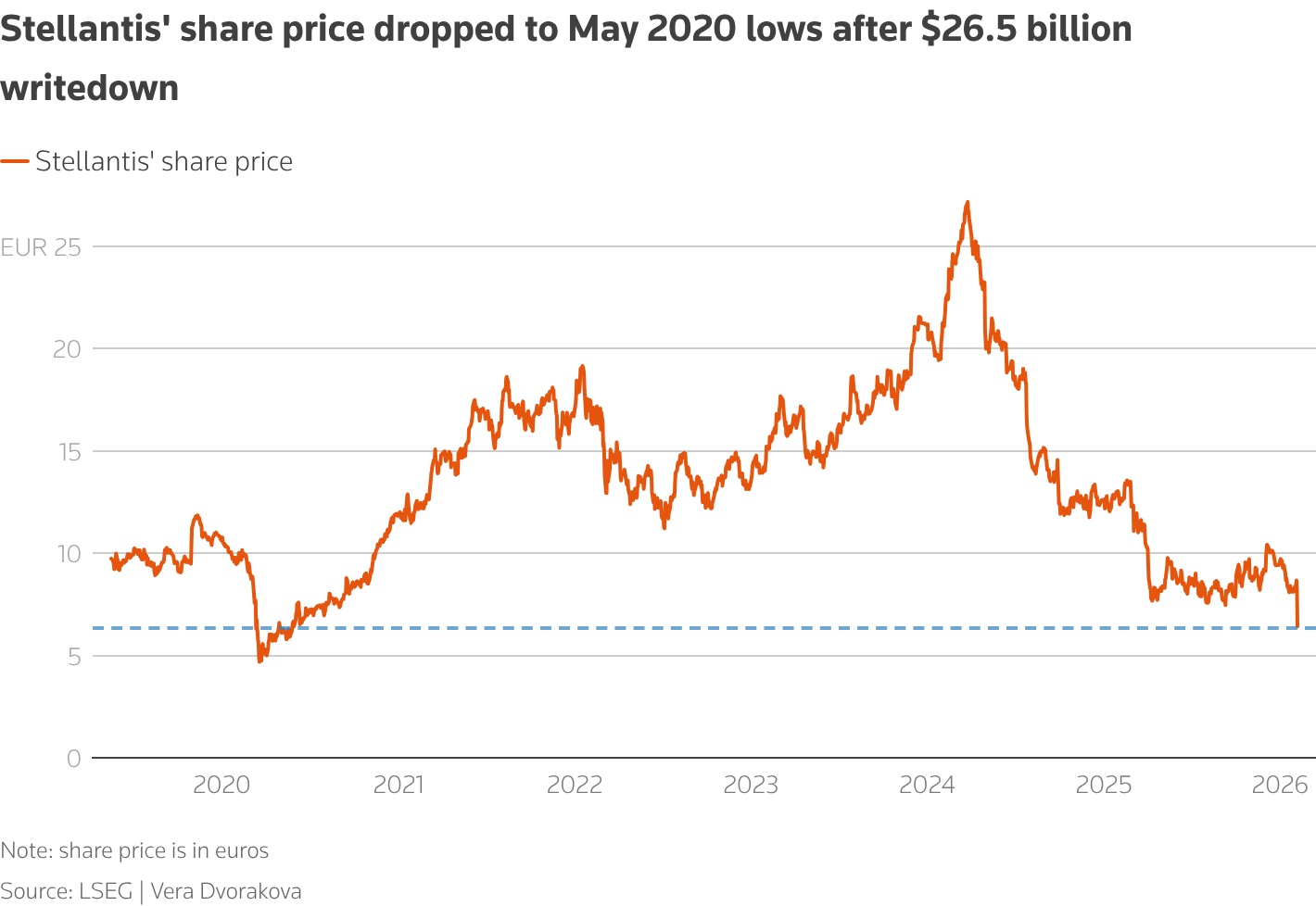

This core announcement centres on a dramatic scaling back of EV investments for the second half of 2025 and beyond. Following the news, Stellantis shares slumped over 20% as investors reacted to the scale of the impairment. The writedown is composed of approximately €14.7 billion related to scrapped product plans and impaired electric platforms, alongside €6.5 billion earmarked for compensation payments to suppliers whose contracts have been abruptly cancelled. Following the resignation of former CEO Carlos Tavares in late 2024, the new leadership under Antonio Filosa has moved with ruthless speed to align the company’s balance sheet with the reality of cooling EV demand and shifting political climates, particularly in the North American market.

The technology focus has shifted from “electric-only” to “demand-governed” electrification. Specific initiatives that were once the cornerstone of the brand’s future have been unceremoniously axed, including the much-anticipated all-electric Ram 1500 REV pickup and several plug-in hybrid variants of Jeep and Chrysler models. As the company takes a $26.5 billion charge, it is reviving the thunder of internal combustion, reintroducing V-8 engines for its flagship pickups and muscle cars while pivoting toward mild-hybrid technology for mainstream models like the Jeep Cherokee. This move is designed for large-scale use in regions where charging infrastructure remains sparse and consumer hesitancy toward pure electrics has reached a boiling point.

Under this new strategy, the roles within the automotive ecosystem have been clearly redefined to survive a period of volatility. While scaling back in the West, the company is leveraging its international ties to stay relevant; for instance, the Leapmotor partnership in Morocco demonstrates a pivot toward more affordable mobility in emerging markets. This allows the automaker to focus its capital on manufacturing flexible platforms that can accommodate petrol, hybrid, or electric powertrains depending on what the customer actually wants to buy, rather than what mandates dictate.

This business shift signals a profound move away from “over-optimism” toward a more pragmatic, profit-first model. Analysts suggest Stellantis is eyeing a reset as it attempts to move past the “jaw-dropping” investment charges. By abandoning unprofitable EV projects and retooling factories for internal combustion and hybrid production, Stellantis is securing its short-term supply chain and mending fractured relationships with dealers who have been struggling with unsold electric inventory. The strategy seeks to secure a competitive advantage by doubling down on high-margin SUVs and trucks, effectively using the profits from fossil-fuelled vehicles to fund a much slower, more sustainable trickle of electrification.

When compared to the global market, Stellantis’ move highlights a deepening divide in the pace of the energy transition. While Chinese manufacturers like BYD continue to scale affordable EV production, other regions are seeing local initiatives attempt to bridge the gap, such as when EV24 Africa launched to support regional infrastructure. This “Big Three” retreat—collectively showing how legacy automakers torched billions on products that the market wasn’t ready for—suggests that the West is lagging behind in the EV race, choosing to protect current dividends and jobs rather than chasing a market that has failed to materialise at the predicted speed.

The execution details of this pivot are being implemented with remarkable haste. In just a few months, Stellantis has moved from flagging operational missteps to full-scale deployment of its “ICE-first” recovery plan. Despite the Stellantis business overhaul and subsequent share plunge, the company is committing to a $13 billion investment in US manufacturing intended to add 5,000 jobs. This shift comes as industry-wide challenges persist, reflected in the latest UK car market 2025 data which highlights the cooling enthusiasm for high-cost electric models. This rapid retooling of factories, such as those in Tennessee and Ontario, demonstrates how quickly the industry can pivot when multi-billion dollar losses are at stake.

The company’s track record has been a tale of two halves; the 2021 merger was initially hailed as a masterclass in scale and efficiency, but the aggressive push into EVs under previous leadership proved to be a bridge too far. Despite the recent financial carnage, Stellantis still holds a strong market position, maintaining the second-place spot in enlarged Europe and seeing a slight rise in US market share to 7.9 per cent. These milestones prove that while the EV strategy may have faltered, the core brands remain resilient and highly desirable to the traditional car buyer.

This moment marks a definitive shift from the era of “EV hype” to a new period of fleet-scale realism, where the survival of legacy carmakers depends on their ability to listen to the market rather than the regulators. It raises a critical question for the coming decade: by retreating from the electric front to safeguard current profits, are Western automakers simply delaying an inevitable defeat at the hands of faster, more focused global competitors? Or is this the necessary correction that will prevent the total collapse of the traditional automotive industry?