CIG Motors has slashed the price of the GAC Aion Y Plus by ₦13 million, bringing the electric SUV down to ₦35 million from its original ₦48 million tag under the Ember Promotion. The move, spanning September through December, positions the 400km-range vehicle as Nigeria’s most accessible premium EV at a time when fuel queues and petrol price hikes are forcing drivers to reconsider what powers their daily commute. For a country where transport costs eat into household budgets and Lagos traffic can turn a 20-minute trip into a two-hour ordeal, this isn’t just a discount—it’s a pivot toward sustainable mobility that finally pencils out for the emerging middle class.

The Aion Y Plus arrives as a compact SUV built on GAC’s electric platform, delivering zero emissions alongside a silent cabin that cuts through the usual Lagos soundtrack of honking horns and revving engines. Early adopters on social media have flagged its responsive handling in tight spaces, spacious interiors that seat five comfortably, and advanced driver assistance systems that include collision warnings and stability control. The 400km range holds up for real-world Nigerian conditions, making inter-city runs like Lagos to Ibadan feasible without range anxiety, while the absence of fuel dependency eliminates the ritual of queueing at petrol stations during supply crunches. For urban drivers juggling errands, school runs, and work commutes, the vehicle’s quiet operation reduces fatigue, a feature that resonates particularly in a city where gridlock can stretch for hours.

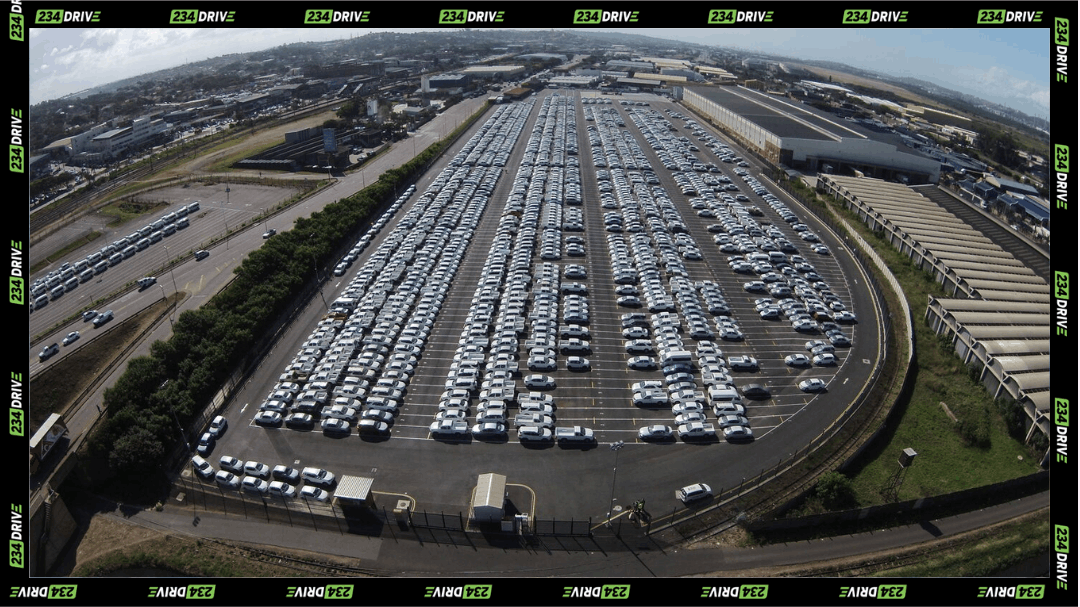

CIG Motors, GAC’s official Nigerian distributor, is handling distribution and after-sales service, with pre-bookings open now and deliveries slated for February 2026. The company’s role extends beyond sales; it’s positioning the Aion Y Plus within a broader push that includes discounts on other GAC models like the GS3 (slashed from ₦35.5M to ₦25M) and the GS4 (down from ₦45.8M to ₦35M). This Ember Promotion strategy mirrors seasonal consumer spending patterns in Nigeria, where end-of-year purchases spike, but it also signals a bet that electric vehicles can crack the market if priced within reach. GAC’s Aion sub-brand, which specialises in new-energy vehicles, brings global EV expertise to a local context where infrastructure gaps, limited charging stations outside major cities still present hurdles. Yet the timing aligns with Lagos State’s THEMES+ agenda, which integrates rail, road, and water transport with clean energy initiatives, creating a policy environment that could accelerate adoption.

The vehicle’s appeal cuts across demographics, but there’s a human angle emerging around women drivers. In a context where traffic stress and safety concerns sometimes deter female participation in driving, the Aion Y Plus offers a calmer alternative. The quiet, emission-free ride reduces the intimidation factor of noisy, maintenance-heavy petrol cars, while AI-assisted features provide real-time hazard alerts on roads notorious for erratic driving. Feedback from electric vehicle test drives in Lagos points to increased confidence among women navigating urban commutes without the added stress of mechanical issues or emissions. This mirrors broader EV trends across Africa, where zero-emission vehicles are increasingly viewed as tools for gender-inclusive transport, enabling safer, more independent travel in environments where public transport options can be unreliable or unsafe.

From a business perspective, this launch is CIG Motors hedging against Nigeria’s volatile fuel economy while positioning itself ahead of competitors in the nascent EV market. As fuel subsidies wane and electricity remains cheaper than petrol over time, operational savings for EV owners could run into millions of naira annually, which becomes compelling when the upfront cost drops by ₦13 million. The warranty and service network offered by GAC aim to address concerns about battery longevity in Nigeria’s hot climate and the scarcity of specialised EV technicians, though these remain open questions until the vehicles hit the road at scale. Reportedly, this represents the largest automotive price slash in the country’s history, a claim that underscores how aggressive CIG is betting on this shift.

Globally, the Aion Y Plus has drawn mixed but largely positive reviews. In markets like Malaysia and South Africa, drivers praise its spaciousness and value proposition, with some citing a 490km range under optimised conditions, though Nigerian specs stick to 400km for realism. Reddit discussions highlight its quirky design and family-friendly layout, with users noting it punches above its weight class in terms of interior room. Comparatively, Nigeria’s EV ecosystem lags behind Ghana, where electric buses have already entered public fleets, and South Africa, where charging infrastructure is more developed. But the pace is shifting: Lagos has introduced electric buses and water taxis, while Port Harcourt has seen locally assembled EVs enter the market, suggesting a regional race toward electrification that CIG Motors is now joining with consumer-facing models.

The track record matters here. GAC, a Guangzhou-based automaker, has steadily expanded its African footprint, and the Aion sub-brand has logged sales across Asia and the Middle East, proving the platform’s durability. CIG Motors itself has built a reputation in Nigeria for importing and servicing Chinese vehicles, and this promotion extends that credibility into the EV space. The company’s infrastructure, showrooms, service centers, and parts availability will be tested as deliveries scale up, but the ₦35 million price point creates a buffer for early adopters willing to bet on CIG’s support network holding up.

This marks the moment when Nigeria’s EV conversation shifts from policy papers and pilot projects to mass-market availability. The question now isn’t whether electric vehicles can work in Nigeria; it’s whether buyers will commit ₦35 million to a technology that still requires them to plan charging stops, trust nascent service networks, and bet on the government maintaining policies like reduced import duties on EVs. If CIG Motors hits its delivery targets and the charging infrastructure expands even modestly over the next two years, the Aion Y Plus could become the vehicle that normalises zero-emission driving in West Africa’s largest economy. Should regulators treat EV charging networks like public infrastructure to speed adoption, or will market forces alone determine whether electric mobility takes hold?