Canada has initialised a transformative shift in its automotive trade policy by slashing tariffs on Chinese-manufactured electric vehicles from a staggering 100% to a mere 6.1%. This move, finalised in January 2026, represents a significant departure from previous years where Canada stood in lockstep with the United States to curb the influx of low-cost Chinese imports. By making this pivot, the Canadian government breaks with US trade orthodoxy, prioritising consumer affordability and domestic climate targets over the protective barriers that have defined North American trade relations since 2024.

The policy shift is the cornerstone of a broader canola trade agreement reached with Beijing, which sees a reciprocal reduction in Chinese duties on Canadian agricultural exports. Under the terms of the new deal, Canada has established a limited import quota starting at 49,000 vehicles per year, with the potential to scale to 70,000 units by the end of the decade. This strategic “reset” is designed to lower the entry price of electric mobility for Canadian families whilst simultaneously encouraging Chinese manufacturers to consider long-term industrial investments within the country’s borders, particularly in the manufacturing heartlands of Ontario.

Tesla Inc. stands as the primary beneficiary of this legislative change due to its existing global production strategy. The company’s Gigafactory in Shanghai serves as its most efficient export hub, and because Tesla has already dropped 100% tariff barriers that previously made these imports unviable, it can now resume large-scale shipments of the Model Y and Model 3. Tesla’s dominance in established markets, such in Norway, provides a template for the rapid adoption Canada hopes to achieve. Unlike emerging Chinese brands that must navigate the lengthy Transport Canada certification process, Tesla’s Shanghai-built vehicles are already compliant with local safety standards, providing an early winner advantage in the region.

The competitive landscape is set to intensify as other established marques with Chinese production facilities also look to capitalise on the lower rates. Volvo, Polestar, and Lotus—all under the umbrella of Geely—possess the necessary certifications to begin immediate deliveries. The impact on pricing is expected to be dramatic; for instance, the high-tech Lotus Eletre is projected to see price reductions of nearly 50%, making it a formidable challenger in the premium SUV segment. Meanwhile, pure-play Chinese firms like BYD are expected to focus on the sub-C$35,000 market, where the BYD and Tesla rivalry will truly take shape as they compete for the affordable half of the government’s long-term quota.

Beyond hardware, Tesla’s software ecosystem remains a key differentiator. The company is actively expanding its technological reach, as evidenced by how Tesla’s FSD is getting a European test drive, suggesting a global push for its autonomous features. For Canadian buyers, the appeal of a subscription for your car via the Full Self-Driving suite adds another layer of value that pure hardware competitors may struggle to match. However, this divergence in trade policy has already begun to strain relations with Washington. US officials have expressed significant concern over the potential for a “backdoor” into the American market, warning that the decision will be regretted as it complicates the upcoming 2026 renegotiation of the USMCA.

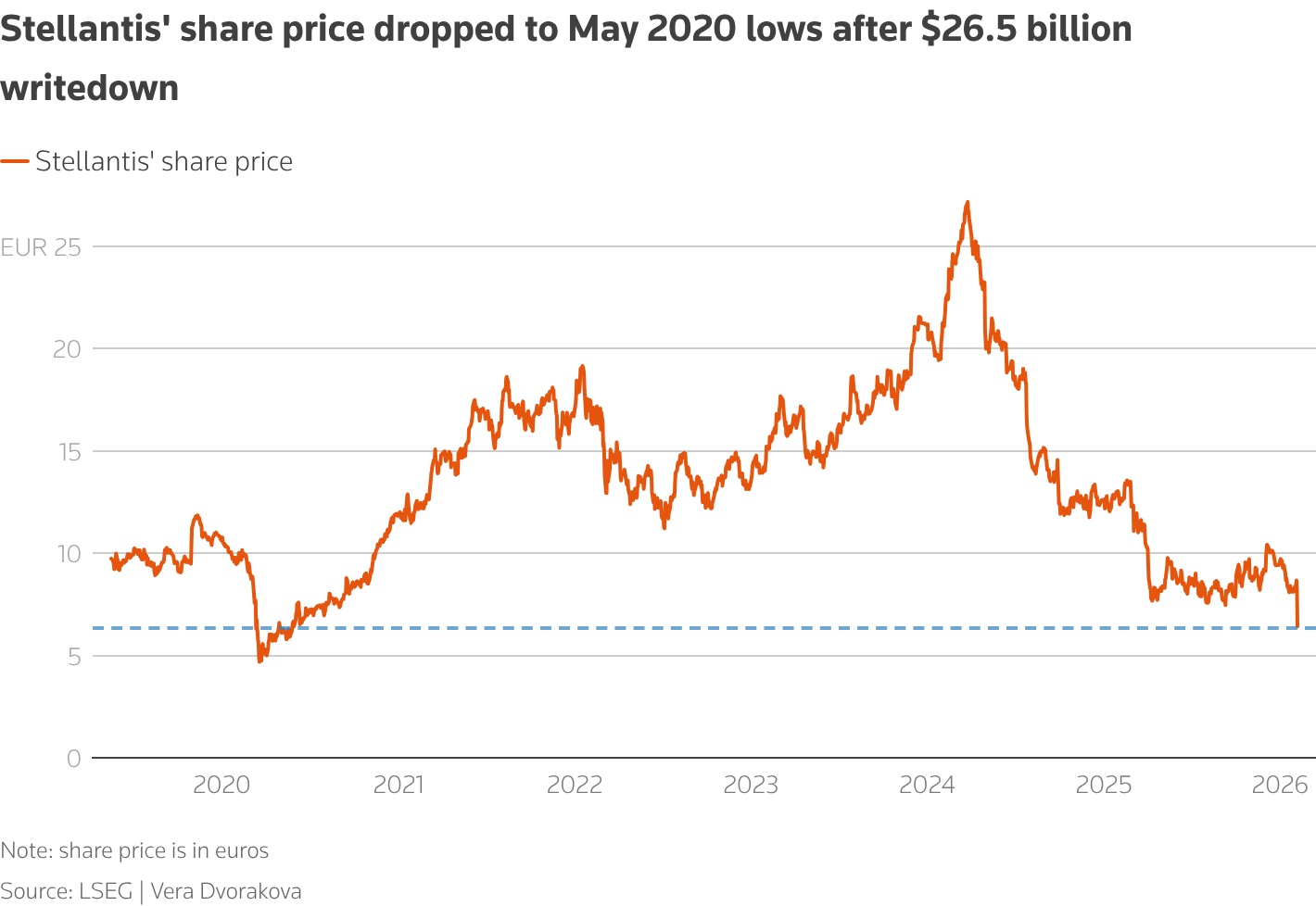

Ultimately, Canada’s decision reflects a gamble that the benefits of rapid electric vehicle adoption and cheaper consumer goods will outweigh the diplomatic risks. The friction highlights a growing geopolitical industry strain across North America, where various regions are balancing trade alliances against local interests. For Tesla, the 6.1% tariff rate offers a lifeline to recover sales figures that slumped during the period of high protectionism. As the first shipments from Shanghai arrive in Canadian ports, the industry will be watching closely to see if this move triggers a price war that finally brings electric vehicles into the reach of the average buyer.