On 27th November 2025, the US Patent and Trademark Office published Tesla’s application for a battery enclosure leak detection system (US20250360794A1), which uses existing pressure and temperature sensors to identify coolant leaks during charging—no new hardware required. The following day, Black Friday, Tesla’s stock closed at $430.17, up a modest 0.84% in light holiday trading. That same week, Tesla rolled out free 30-day trials of FSD Supervised version 14.2 to roughly 1.5 million North American owners, and on 1 December began supervised passenger ride-alongs in European cities including Berlin, Paris, and Milan. Contrary to some reports circulating online, no patent for batteries delivering 20% more range appeared in late November, and the stock’s modest gain reflected broad market sentiment and FSD enthusiasm rather than a battery density breakthrough.

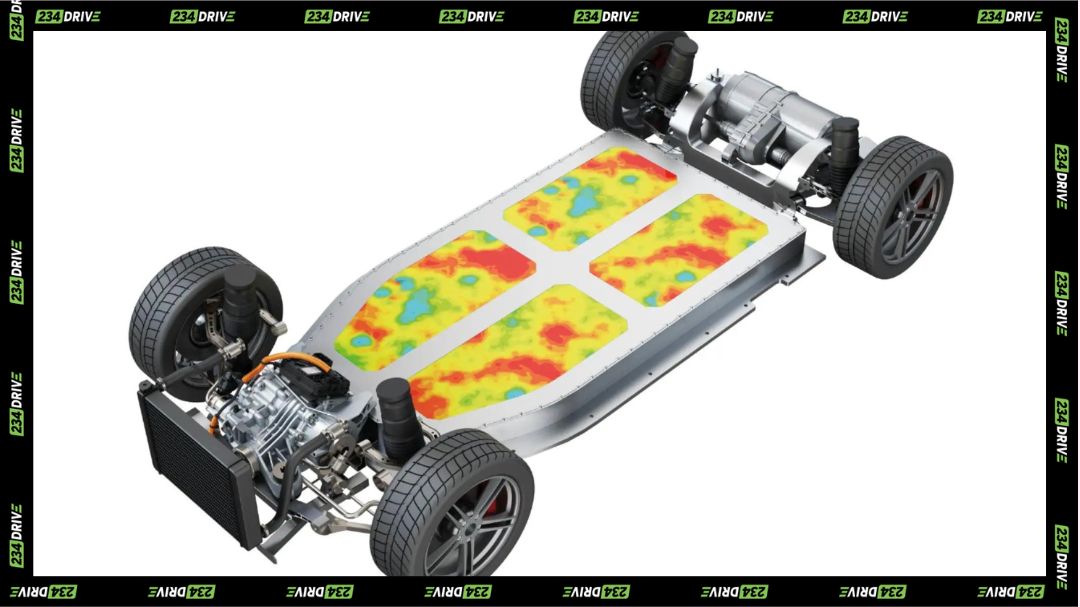

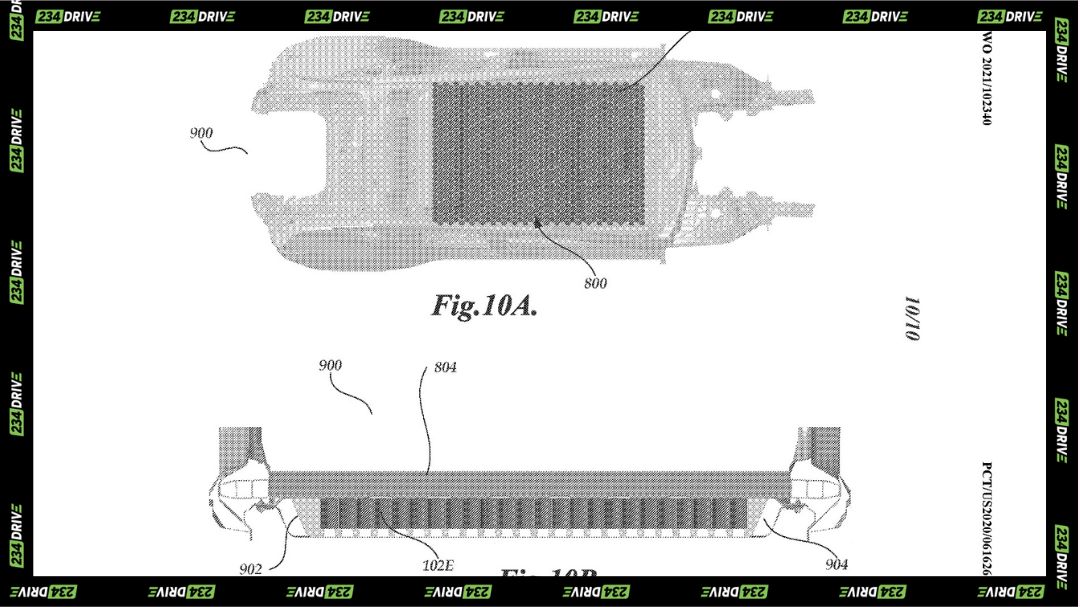

The leak detection patent represents practical engineering rather than revolutionary science. Tesla’s system monitors pressure changes inside the battery enclosure during thermal events—particularly whilst charging, when coolant circuits are under stress. If a leak begins, pressure drops in a predictable pattern that existing sensors can catch before the problem escalates into a thermal runaway event or stranded vehicle. This approach aligns with Tesla’s acquisition of battery inspection technology from Germany’s Manz AG earlier in 2025 and reflects the company’s focus on manufacturing quality and safety at scale. It’s the kind of unglamorous innovation that prevents recalls and warranty claims, not the headline-grabbing energy density leap that sends stock prices surging.

Separate reporting on Tesla’s battery chemistry has highlighted cathode doping improvements that boost charge retention to approximately 91% after repeated cycles, compared to 83% in previous formulations. This advancement impacts battery longevity and real-world usability—allowing owners to routinely charge to 90% without accelerated degradation—but it doesn’t increase the energy density of individual cells or extend single-charge range by 20%. Battery technology at Tesla evolves incrementally, with major density announcements historically reserved for events like 2020’s Battery Day rather than individual patent publications. The company’s longer-term goals around 4680 cell production and dry electrode technology remain focused on cost reduction and manufacturing scalability as much as raw performance gains.

Tesla’s stock movement on 28th November was unremarkable by the company’s volatile standards. Markets operated with shortened hours for the Black Friday holiday, and TSLA opened at $426.59 before closing at $430.17—a gain of just $3.59 or 0.84%. Trading volume came in at roughly 36 million shares, well below the typical daily average, consistent with reduced holiday participation. The stock had closed the previous trading session on 26 November at $426.58, meaning the Black Friday gain simply recovered minor ground. Year-to-date, Tesla shares remained up approximately 6.5% through late November, driven primarily by energy storage business growth and optimism around autonomous technology monetisation rather than any single catalyst in the final week of the month.

The real momentum in late November came from Full Self-Driving software, not batteries. Tesla released FSD Supervised version 14.2 with wider deployment to Hardware 4-equipped vehicles and incremental improvements for Hardware 3 cars. Owners and testers described the update as a significant step forward in edge-case handling, parking manoeuvres, and low-speed navigation, though highway performance had already been strong in previous versions. The free 30-day trial initiative—timed to coincide with holiday travel—aimed to convert sceptics into paying subscribers by letting them experience the system’s capabilities firsthand during long road trips. Elon Musk and beta testers have suggested version 14.3 is imminent, with expectations for continued refinement heading into 2026.

Europe represents Tesla’s most important near-term regulatory frontier for autonomous driving. The supervised ride-alongs which started on 1st December in Germany, France, and Italy allow Tesla to collect real-world driving data under controlled conditions whilst demonstrating the technology to regulators. This marks a critical milestone toward broader European approval, which could arrive in 2026 if data collection proceeds smoothly. Unlike the United States, where Tesla has deployed FSD widely under existing frameworks, European regulators require more extensive local validation before permitting unsupervised autonomous operation. Other markets face different challenges: South Korea’s limited rollout applies only to US-built Teslas due to free trade agreement rules, whilst Japan’s software-focused approval process suggests a potentially smoother path to deployment.

Globally, Tesla’s FSD programme now stands as the most advanced driver-assistance system commercially available, with a widening gap between its capabilities and competitors’ offerings. Traditional manufacturers like Mercedes-Benz and BMW have launched conditional automation features in limited scenarios, but none match the breadth of environments where Tesla’s system operates. Chinese competitors including Xpeng and Huawei are advancing rapidly in their domestic market, but their systems remain geographically constrained. Tesla’s combination of fleet scale—millions of vehicles collecting data—and vertical integration of hardware, software, and neural network training gives it structural advantages that competitors struggle to replicate.

Analysts increasingly view FSD and robotics as Tesla’s primary value drivers beyond vehicle sales, with some projecting market capitalisations exceeding $2 trillion by 2026 or 2027 if unsupervised autonomy achieves meaningful scale. That outlook depends on regulatory approval, technical reliability, and consumer adoption—all of which remain uncertain. Version 14.2’s free trial campaign serves as both a marketing initiative and a real-world stress test, generating data on how the system performs across diverse driving conditions whilst building a potential subscriber base.

Battery innovation at Tesla continues along parallel tracks: the leak detection patent published in late November addresses immediate quality control and safety concerns, whilst longer-term research focuses on 4680 cell production ramp, dry electrode manufacturing, and material science advances that could eventually deliver the kind of density improvements rumoured in some reports. But those breakthroughs remain future goals rather than November 2025 reality. Tesla’s current battery strategy emphasises cost reduction and manufacturing scalability as much as performance, recognising that winning the mass-market EV transition requires affordable cells produced at unprecedented volume.

The contrast between Tesla’s battery and software trajectories is instructive. Battery technology advances incrementally through materials science and manufacturing process improvements—unglamorous work that compounds over years. Software, by contrast, can leap forward with over-the-air updates that fundamentally change how millions of vehicles behave overnight. FSD version 14.2 represents exactly that kind of transformation, and the European ride-alongs signal Tesla’s ambition to replicate its North American success in the world’s most skeptical regulatory environment. Whether a leak detection patent or a 20% range increase makes headlines, it’s the software that’s rewriting the rules.