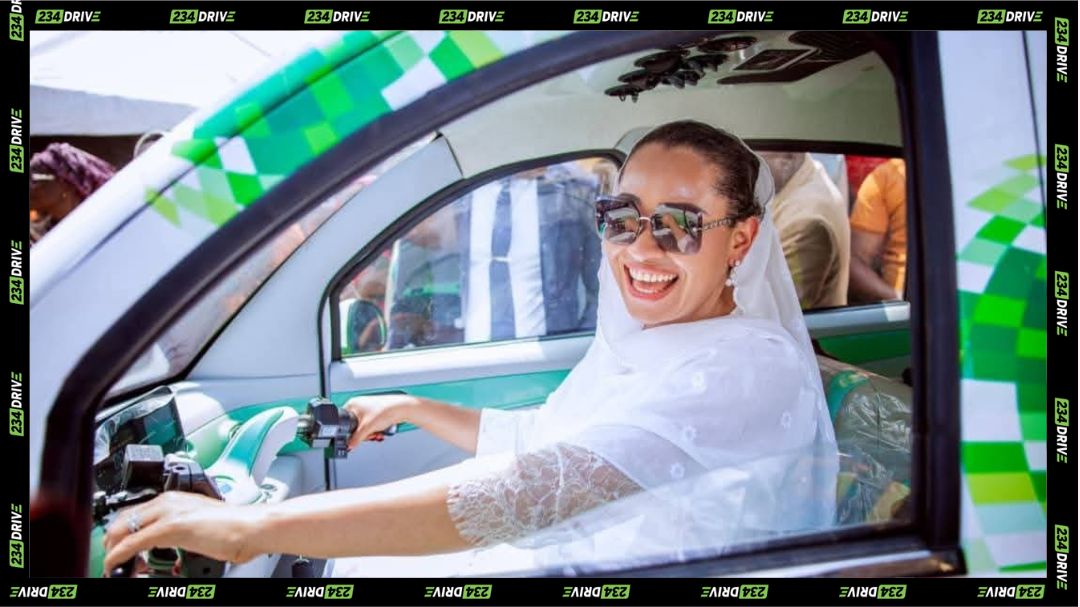

A BYD electric model draws commuters’ attention as the brand steps deeper into emerging mobility hubs in Africa.

BYD is one of the world’s leading EV makers, selling as many as 4.3 million cars in 2024, a 40% increase from the previous year. The Chinese carmaker is looking to bump up these numbers by taking a decisive step into the African automotive market. With its African strategy currently anchored in South Africa, BYD is preparing a large-scale charging infrastructure rollout across the continent.

The charging infrastructure is set to help ease its integration into one of Africa’s largest car markets; the plan works hand in hand with key partnerships in East Africa and a long-term roadmap that could potentially include local manufacturing if demand grows.

BYD’s History In Africa: The Story So far.

BYD’s presence in Africa began long before its recent electric passenger-car push. The company first entered the continent in 2004, introducing clean-energy products and commercial electric buses. By 2010, South Africa had become the focus of these early efforts, highlighted by BYD’s electric-bus showcase at the 2012 Johannesburg International Motor Show.

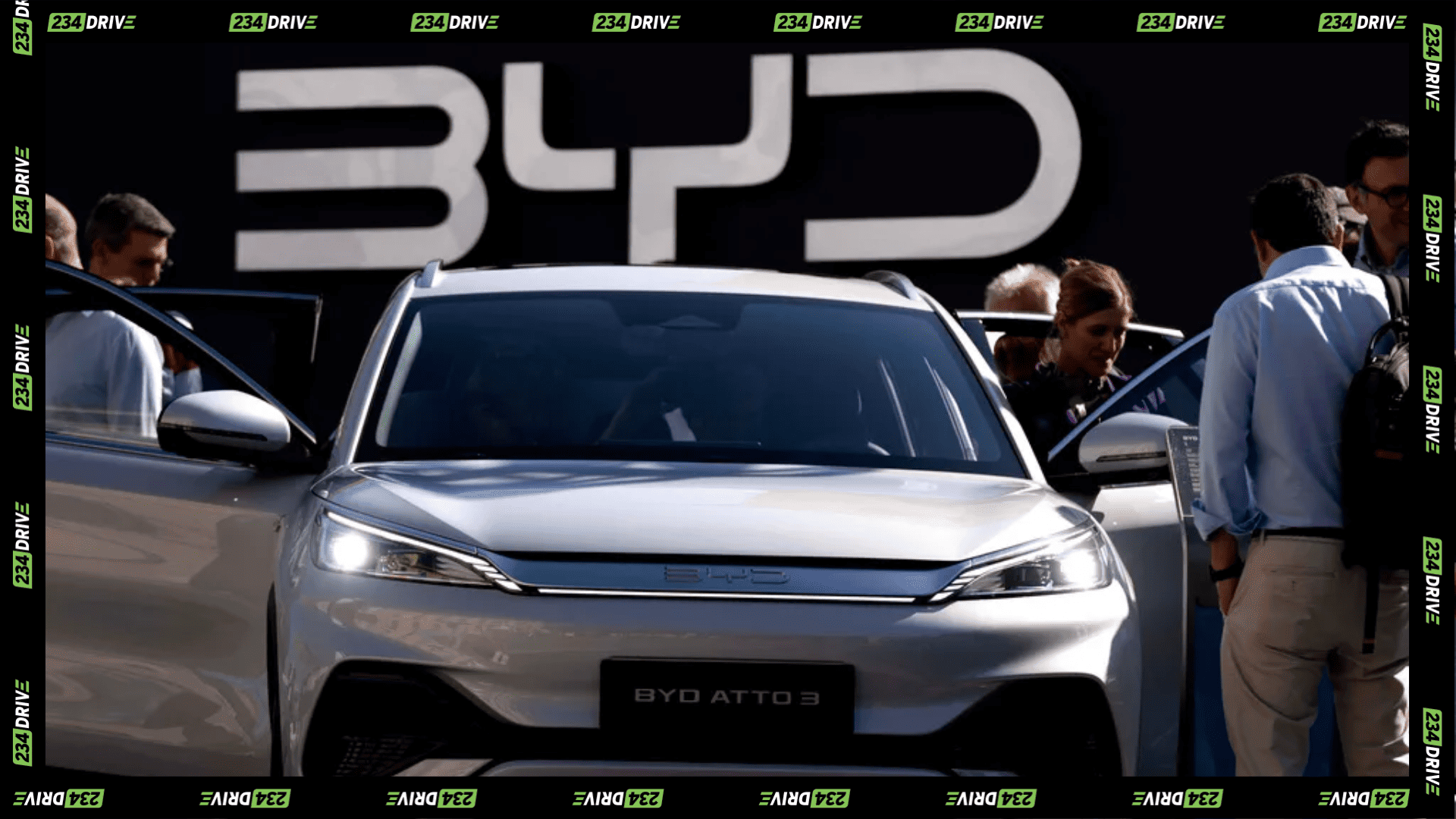

Its consumer push arrived much later. BYD formally entered South Africa’s passenger-car market in mid-2023 with the Atto 3, then accelerated expansion across the region. The company moved into Kenya (2022), Rwanda in early 2024, Zambia by the third quarter of 2024, and most recently Benin and Gabon, where it launched the Yuan Plus SUV and Seagull hatchback with distributor CFAO Group.

BYD now operates in 17 African countries, a footprint that has grown quickly since it stopped producing traditional combustion-engine vehicles in March 2022 to focus fully on plug-in hybrids and battery-electric models.

Why South Africa Became BYD’s Launchpad for African Expansion

Since BYD started selling its passenger vehicles in South Africa, it has not taken its foot off the gas pedal and continues to build out its dealership footprint. Even when the company initially entered into a market crowded with long-established global manufacturers such as BMW and Toyota, many of which already operate local production plants.

The plan to anchor BYD’s African expansion in South Africa was a deliberate choice shaped by two key factors:

- The country already having a mature automotive industry with strong manufacturers and reliable supply networks.

- Its market size and infrastructure provided a stable base for BYD to expand across the continent.

Why BYD Is Making Charging the Foundation of Its EV Push

BYD is growing its presence in South Africa and plans to make it easier for people to switch to electric cars by building more places to charge them. The company aims to install 200 to 300 charging stations in 2026. These will first appear at BYD dealerships, then along major highways, and later in busy city areas. Many of the stations will use solar power to lessen pressure on the country’s unstable grid.

A big part of this push is the Dolphin Surf, which starts at R340,000 and is one of the first electric cars priced for everyday buyers. Its early interest shows that when a car is affordable and charging is easy to find, more South Africans are open to choosing an EV.

BYD has not said how much it will spend, but it plans to invest heavily as the rollout continues.

Regional Partnerships Across Africa

Beyond South Africa, BYD is building a wider presence across the continent through partnerships and early market testing. In East Africa, its work with Ampersand Energy supports electric motorbike production and charging in Rwanda and Kenya, two markets where two-wheelers are growing faster than electric cars. BYD also works with CFAO Mobility in Rwanda, which helps reduce shipping challenges and makes it easier for customers to access its vehicles.

West Africa is opening up as well. In Nigeria, BYD has started making introductions into the market, including partnering with Africa’s leading mobility media, 234Drive, to run test drives for people interested in owning an EV. Its broader agreement with CFAO Mobility also supports distribution across the West African region.

Furthermore, other parts of the continent are developing important roles of their own. Ethiopia plans to use its lithium and cobalt reserves to build a full electric-vehicle value chain—from mining and refining to battery assembly and vehicle production—so more of the EV process happens locally. Meanwhile, Kenya’s shift from early imports of fully built EVs to local assembly of buses, motorbikes, and cars shows how quickly the ecosystem is growing.

While South Africa is currently the main entry point for Chinese EV makers, the momentum in West, East, and Northern Africa suggests the continent could eventually host several regional hubs rather than a single automotive capital.

Manufacturing on the Horizon in Africa?

BYD has not confirmed any plan to build cars locally in Africa. However, it has openly said it may do so if sales justify the investment. The company points to its Brazil plant as an example of how local manufacturing can follow rising demand, and South Africa is currently the most logical location.

A Clear Direction for BYD in Africa?

Even though it’s not in fine print yet, BYD’s Africa strategy is taking shape around a simple pathway: enter through South Africa, build infrastructure, expand through partnerships, and keep the door open for future manufacturing.

The combination of early dealership growth, a far-reaching charging plan, and regional mobility partnerships positions BYD as one of the continent’s most aggressive electric-vehicle expansion efforts.